JUNE Agri Review: The Sector at a Glance

There was 2.1% decrease in agricultural production in 2017 compared to the previous year. Production in the plant-growing sector declined by 0.4%, while animal production experienced a decrease of 3.8%. Lower production resulted in lower self-sufficiency ratios for most agricultural products.

Revenue from the sale of agricultural products in 2017 also decreased compared to the period 2014-2017, both in percentage and absolute terms. Reduced production is the most likely reason for this.

While revenue from selling agricultural products decreased in 2017, the level of commercialization in the sector has increased. This trend is particularly persistent in animal production, where its share in enterprises increased from 21% to 27%. Since in light of DCFTA, more food safety regulations will be adopted in the future, it is expected that the share of enterprises will grow even faster. As to plant growing, the share of enterprises in 2017 has increased as well, but there are no increasing trends observed in general, since the share keeps changing its direction from year to year.

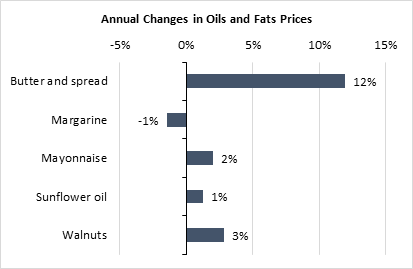

Price Highlights

In May 2018, prices in the group of oil and fats increased by 4.6%, compared to May 2017. According to Geostat data, the main drivers were butter and spread prices, which went up by 12%. As shown in the diagram, there were slight price hikes for walnuts (3%), mayonnaise (2%), and sunflower oil (1%). Meanwhile, prices slightly decreased for margarine (-1%). One explanation for increased butter prices might be the recent spike in international prices; according to the Global Trade Info, starting in January 2018, butter prices have been increasing compared to the previous year. The structural changes in the dairy sector might be putting additional upward pressure on butter prices. On July 1, 2017, changes in technical regulations for the dairy sector came into force, which probably increased the production costs of butter as producers must comply with stricter food safety regulations and standards. More specifically, producers are not allowed to label product as “butter” if it contains vegetable or other kinds of oil.

Trade Highlights

In May 2018, Georgia’s agricultural exports (including food) amounted to 68 mln USD, which is around 27% of total Georgian export value. This indicator is 39% higher than in May 2017. As to imports, in May 2018, Georgia’s agro imports stood at 100 mln USD, which constitutes 27% of total Georgian imports. Year over year (compared to May 2017), agricultural imports increased by 6%.

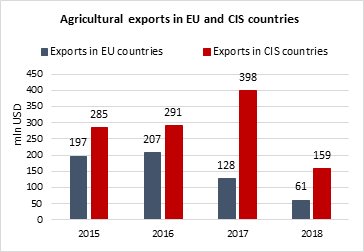

In 2016, Georgia’s agricultural exports in EU countries (including Great Britain) increased by 5% compared to the previous year, while during 2017, a 38% decrease was observed compared to 2016. This change is mainly caused by a significant decrease (64%) in hazelnut exports. It is worth mentioning that main hazelnut export market is the EU countries. As of June 2018, agricultural exports in the EU amounts to 61 mln USD.

In the last couple of years, Georgia’s agricultural exports to CIS countries are increasing; there was 2% increase in agro exports in 2016 compared to 2015, but a 37% increase in 2017 compared to 2016. This was mainly caused by increased exports of alcoholic and non-alcoholic beverages (wine by 61%, spirits by28%, mineral and aerated waters by 22%). As of June 2018, agricultural exports to CIS countries amount to 159 mln USD.

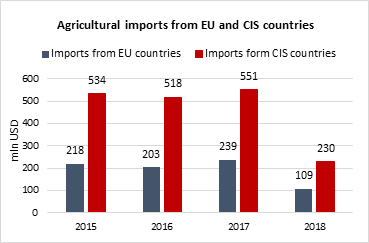

As for imports from the EU and CIS countries, there are no significant changes on an annual basis and steady trends have not been observed for either EU or CIS countries. Imports from both regions decreased in 2016 compared to 2015, and increased in 2017. As of June 2018, agricultural imports from EU and CIS countries amounted to 109 and 230 mln USD, respectively.