September 2018 Agri Review: The Sector at a Glance

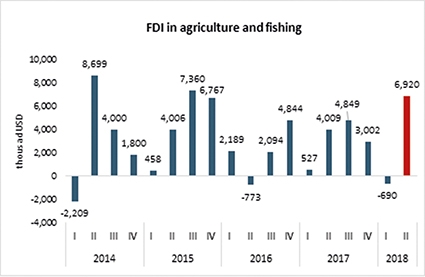

Agricultural production decreased by 0.8% in the second quarter of 2018 compared to the same period in 2017. In spite of decline in agricultural production, FDI in agriculture has increased. While FDI in agriculture is relatively low compared to the other sectors of the Georgian economy, it should be noted that agricultural FDI in the second quarter of 2018 reached its maximum of the last three years.

Increased FDI is not the only good news for the sector, another one is related to “Rtveli”, which started on August 20, and was not subsidized by the government for the first time in ten years. This change in the policy is expected to lead to better quality wine and more competitive grape growers and wine producers.

Since Rtveli is not over yet, official statistics about the amount of grapes sold by farmers and their incomes, is not yet available. Although, according to the Ministry of Enrvironment Protection and Agriculture, the current Rtveli is notable for a higher amount of grapes sold and even higher incomes for grape growers.

DOMESTIC PRICES

On a monthly basis, the price level in the country held relatively steady; the Consumer Price Index (CPI) in August 2018 slightly increased by 0.5% compared to July 2018. Compared to August 2017, the CPI experienced a 3.1% increase.

In the category of food and non-alcoholic beverages, prices increased by 1.5%, contributing 0.44 percentage points to the overall CPI change. The main drivers were price changes in the following sub-groups: vegetables (16.4%↗), fruits and grapes (-16.2%↙), milk, cheese and eggs (4.8%↗).

From an annual perspective (August 2018 vs. August 2017), the prices of food and non-alcoholic beverages increased by 3.2%, contributing 0.96 percentage points to the annual inflation rate.

The sharpest price changes were observed for the following sub-groups: vegetables (24.7%↗), fruits and grapes (-17.1%↙), milk, cheese and eggs (44%↗).

DAIRY PRICES IN THE SPOTLIGHT

In August 2018, prices in the group of milk and milk products increased on a monthly basis as well as on an annual basis. As shown in the diagram, annual prices increased for milk (7%), Sulguni (6%), condensed milk and milk containing products (5%), fresh cheese (4%), cottage cheese (3%), manufactured milk (2%), yogurt (2%), and sour cream (1%). Meanwhile, prices decreased for Matsoni (-2%). According to milk producers, the main driver of increased prices was decreased milk production. Milk production decreased by 5% in both first and second quarters of 2018 compared to the same periods of the previous year (Geostat, 2018).

The international prices of milk decreased; in August 2018, the Food and Agriculture Organization (FAO), Dairy Price Index decreased by 10. 7% compared to August 2017, reflecting the expectations of increased milk production in New Zealand.

Moreover, the price of milk powder decreased. This could be a good news for Georgian dairy producers. In November, when milk production tends to decline even more, imported milk powder is used in dairy production.

Accordingly, dairy producers will be able to buy milk powder at cheaper prices and reduce the production costs, which might finally translate into lower prices for milk and milk products.

INTERNATIONAL PRICES

International prices decreased in August 2018. The Food Price Index, measured by the FAO decreased by 5.4% in August 2018, compared to the previous year. Prices dropped for the following sub-categories: Sugar (-22.8%), Vegetable Oil (-16%), Dairy (-10.7%), and Meat (-4.6%). It is worth to note that in August 2018 FAO Sugar Price Index continued to decrease and marked at the lowest level in a decade. Such sharp decline in August was driven mainly by the continued depreciation of Brazilian and Indian currencies against the US dollar.

TRADE HIGHLIGHTS

During August 2018, Georgia’s agricultural exports (including food) amounted to 51 mln USD, which is around 25% of total Georgian export value. While comparing this indicator to August 2017, it is 7% lower. As to imports, in August 2018, Georgia’s agro imports stood at 90 mln USD, which constitutes 15% of total Georgian imports. Year over year (compared to March 2017), agricultural imports increased by 3%.

EXPORT DIVERSIFICATION

During August 2018, Georgia’s agricultural exports (including food) amounted to $51 mln, which is around 25% of total Georgian export value. While comparing this indicator to August 2017, it is 7% lower. As to imports, in August 2018, Georgia’s agro imports stood at $90 mln, which constitutes 15% of total Georgian imports. Year over year (compared to March 2017), agricultural imports increased by 3%.

IMPORT DIVERSIFICAITON

As to import diversification, the highest HHI for agricultural imports by product was observed in August 2017 (0.043), while the lowest (0.022) - in March 2018. The highest HHI for agricultural imports by countries was observed in February 2018 (0.132), while the lowest was in January 2018 (0.097).

POLICY WATCH

The implemnetation of National Animal Identification System (NAITS) continues

With the support from international donors the Government of Georgia has started to work on NAITS back in 2016. Identification and registration of animals is vital for ensuring tracking of animal products, which creates the basis for well-functioning food safety system in the country.

For more information: www.interpressnews.ge/ka/article/512386-cxovelta-identipikaciis-programis-implementacia-oie-konperenciaze-ganixiles

Subsidies for berry producers

The Government of Georgia has initiated new support program for berry producers. According to this program, berry production is fully subsidized in selected five regions of Georgia. The subsidy covers purchase of seedlings and the whole production process which includes the cost of local or imported seedlings, drip irrigation and other inputs needed for berry production.

For more information: www.bpn.ge/finansebi/49018-ra-sheghavathebi-sheekhebath-kenkrovani-kulturis-gashenebisas-metsarmeebs.html?lang=ka-GE