FDI: Important Source of Growth Financing

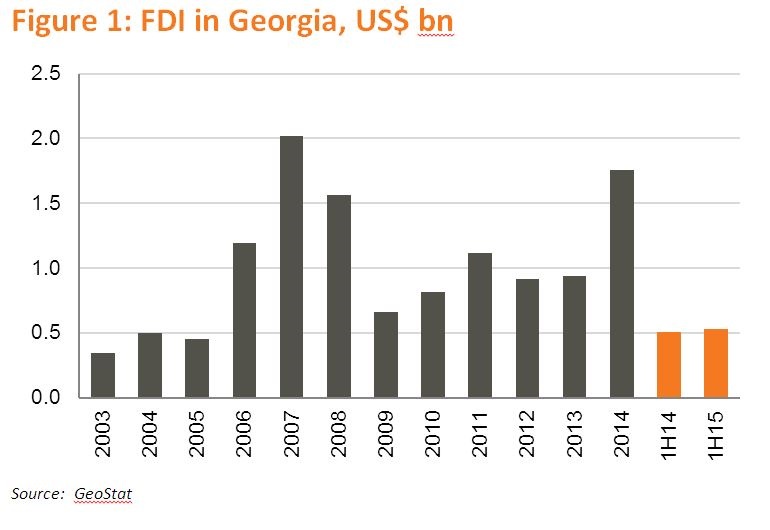

Georgia continues to attract FDI despite the uncertainties in emerging markets. FDI surged in 2014 to US$ 1.8bn, a record high since 2007, boosted by investments in transport and communication (US$ 433.7mn, up 209.5%), construction (US$ 316.6mn, up 535.1%), and manufacturing (US$ 205.4mn, up 105.9%). The upward trend has persisted into 2015, with total FDI increasing 4.8% y/y in 1H15.

FDI is considered an important source of growth financing in countries with inadequate domestic savings. It was one of the main factors supporting the 6.3% average annual growth rate in Georgia from 2003 to 2014. More importantly, this growth was driven mainly by productivity gains. According to the World Bank calculations, which cover the period from 1999 to 2012, productivity gains accounted for 66% of growth. FDI was likely a key element in efficiency improvement as it brings not only financial resources, but also essential know how.

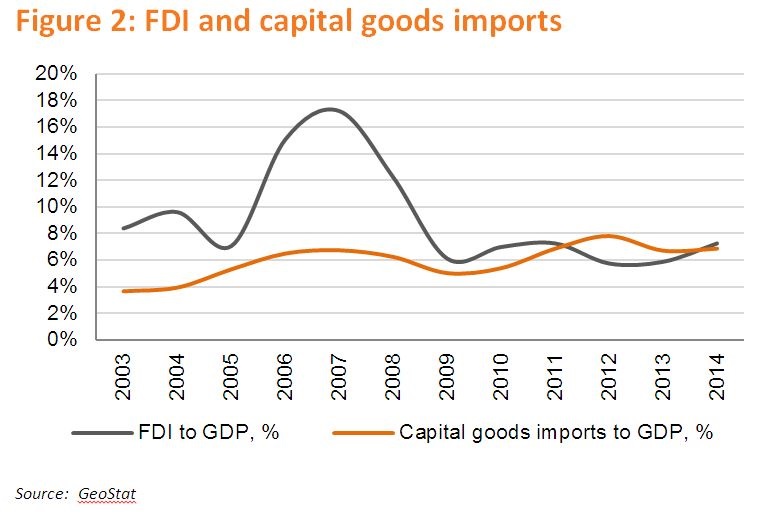

At the same time, FDI has been driving imports, contributing significantly to the current account deficit. As FDI increased in 2014, the current account deficit widened to 9.7% of GDP from 5.7% in 2013. A significant share of FDI is directed towards the acquisition of capital goods, which are, in turn, imported. FDI that drives capital goods imports can be considered more beneficial. Foreign investors can buy existing enterprises or build new ones. The latter requires additional capital goods and naturally expands the output capacity of the country, laying solid ground for future growth.

As long as FDI is expanding the economic output capacity of the country, the associated external deficit is not a threat since (1) a drop in FDI immediately results in a corresponding reduction in the deficit, ruling out concerns for external financing needs; and (2) expansion of output is laying ground for enhanced export potential (both in goods and services) in the future.

Service exports hold great promise for Georgia, which has been positioning itself as a regional hub for tourism, transport, communication, and financial intermediation, among other services. In terms of tourism, Georgia has already reached new heights with the number of foreign arrivals increasing from 560,000 in 2005 to 5.5 million in 2014. Past data can shed light on FDI’s potential role in this achievement. While FDI to GDP was on average 12.7% from 2007 to 2009, FDI in tourism was 66.9% of the value added in tourism, likely contributing significantly to the necessary capacity expansion for hosting the increasing number of tourists. Investments in transport and communication are also far above average, resulting in a significant increase in the country’s transit capacity. Transit accounted for 65% of cross-border road and rail shipments and 95% of pipeline shipments in 2014. Moreover, Georgia has already become a regional energy transit corridor with approximately 1.6% of the world’s oil production and diversified gas supply passing through the country. The attractiveness of these sectors for FDI over the years has validated the soundness of positioning the country as a regional hub. It is crucial that further efforts are invested in this direction to keep FDI flowing.

While FDI was among the major sources of growth financing in Georgia, buildup of the nation’s non-tangible assets, such as ease of doing business and institutional development, has been indispensable in attracting FDI. Pursuing further development in that direction is key to attracting new investors, further improving productivity, and increasing the domestic capacity of export-generating sectors.

Alim Hasanov (Galt and Taggart)