Electricity Market Watch

Sectorresearch is one of the key directions of Galt & Taggart Research. We currently provide coverage of Energy, Healthcare, Tourism, Agriculture, Wine, and Real Estate sectors in Georgia. As part of our energy sector coverage, we produce a monthly Electricity Market Watch, adapted here for Georgia Today’s readers. Previous reports on the sector can be found on Galt & Taggart’s website - gtresearch.ge.

Annual forecast for 2018 electricity balance revised

Electricity consumption growth rate was revised upwards by 3ppts for 2018. On August 27, 2018 Ministry of Economy and Sustainable Development updated the forecast of electricity (capacity) balance for 2018. Based on this document, forecast for electricity consumption in 2018 was revised upwards to 13.0TWh, which is 9.9% y/y increase and the highest growth of electricity consumption since 2010. This growth in demand expected to be satisfied by increased thermal generation and imports. Notably, imports are planned at last year’s record high level. The new balance also incorporates the changes into legislation made in May 2018 regarding the eligibility criteria for direct consumers and traditionally includes actual figures for 7M18..

Electricity consumption and generation – August 2018

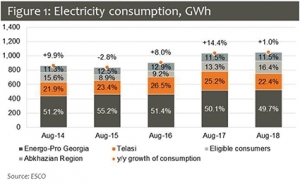

Electricity consumption growth slowed in August 2018, increasing by just 1.0% y/y after the 11.8% y/y growth during May-July period. The slowdown in growth can be explained by the high base of August 2017 (+14.4%) and favourable weather conditions leading to decreased needs for air-conditioning. Consumption in 8M18 was up by 7.7% y/y.

Eligible consumers’ increased their consumption by 24.4% y/y, explained by addition of new companies to the group of eligible consumers, in line with legal changes effective since May 2018.

Consumption by distribution licensees was down by 3.1% y/y in August 2018, caused by above-mentioned reallocation of eligible consumers and favorable weather conditions. Despite addition of new commercial and household subscribers in the group, it was not sufficient to fully absorb the mentioned reasons for the decreased consumption.

There was no export of electricity in August 2018 because of the deficit in the system. Generally, August is considered as an export month, but high growth in electricity consumption led to significantly low exports of electricity during 2015-2017 (3-year average at 28GWh).

Drop in hydro generation (-12.3%y/y) caused thermal generation (+81.2%) and imports (36.7%y/y) growth in August 2018. The low volume of hydro Generation is explained by bad hydrological conditions and maintenance works on some regulated HPPs. Notably, generation of new HPPs increased in August, contributing positively to the total supply of electricity. A 9.2% of electricity demand was satisfied by electricity imports from Azerbaijan (65.7% of imports) and Russia (34.3%).

The guaranteed capacity fee was down 3.8% y/y to USc 0.54/kWh in August 2018. The TPPs under maintenance were Mtkvari Energy and Block 4 of Tbilsresi; others provided guaranteed capacity for almost entire month.

Electricity prices in Georgia and Turkey

Wholesale market prices in Georgia increased 0.6% y/y to USc 4.7/kWh in August 2018. A 16.4% of total electricity supplied to the grid in August 2018 was traded through the market operator ESCO, with the rest traded through bilateral contracts. Average price of electricity imports to Georgia was down 6.4% y/y to USc 4.6/kWh in August 2018.

Turkish electricity prices increased by dramatic 70.6% y/y in TRY terms, but in US$ terms y/y growth was mere 4.6%. This was market reaction to TRY’s radical depreciation in August 2018 as energy sector is highly sensitive to FX movements and is anchored to US$, based on analysts’ assessments. In august 2018, average electricity prices in Turkey reached US$ 5.3/kWh

By Mariam Chakhvashvili