Tourism Remittances, FDI & Capital Spending Up but Food Price Inflation Spoils the Festive Mood

ISET-PI has updated its forecast of Georgia’s real GDP growth rate for the fourth quarter of 2019 and the first quarter of 2020. The highlights of this month’s release are as follows:

HIGHLIGHTS

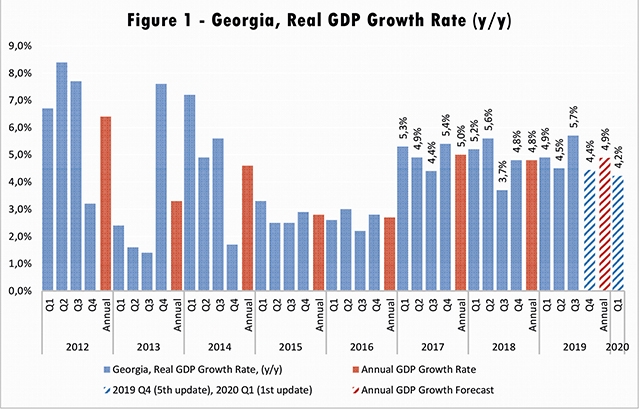

• The real GDP growth rate reached 5.7% y/y in October 2019. As a result, estimated real GDP growth for the first ten months of 2019 was 5.1%.

• ISET-PI’s real GDP growth forecast for the fourth quarter of 2019 remains at 4.4%.

• Based on October’s data, we expect annual growth in 2019 to be 4.9%.

• ISET-PI’s forecast for Q1 2020 GDP growth is 4.2%.

Based on October’s data, the growth forecast for 2019-2020 remains largely stable. While changes in the current GDP forecast do not appear to be significant, a number of variables deserve our attention. In particular favorable economic conditions in the wider region, improved external statistics for Georgia, increased national and foreign currency deposits, and inflation rate above the targeted value all have influenced the GDP growth forecast.

External Statistics

The first eight months of 2019 were characterized by improved economic conditions in Georgia’s neighboring countries. The Armenian economy advanced on average by 6.4% y/y in the summer of 2019, while Russia’s real GDP grew by about 2.2% in the same period of 2019. Furthermore, the annual real GDP growth in Azerbaijan and Belarus amounted to 2.4% and 1.1% respectively in the first eight months of 2019. These favorable economic developments in Georgia’s immediate neighborhood and the wider region further stimulated our economy through the trade, remittance, and tourism channels.

In October 2019, exports grew by 4.5% y/y and this growth was mainly driven by the following: significant increases in re-export of motor cars and trucks to Armenia; recovering exports of wine and mineral water to Russia; export/re-export of copper ores and concentrates to Belarus; growing re-export of motor cars to Ukraine. During the same period, imports decreased by 2.1% and as a result the trade balance (net-exports) improved by 5.7% y/y (trade deficit declined to 531 million USD).

Remittances and tourism, together with foreign direct investment (FDI), are among the main sources of foreign exchange flow into Georgia. In October, remittances increased by 11.5% relative to the same month of the previous year. As in the previous month, the main contributors to this growth were Kazakhstan (remittances up by 127%, which amounted to a 1.3 percentage point contribution), Italy (remittances up by 24.6%), Greece (up by 19.7%) and Poland (up by 32.4%). Overall, however, remittances from the EU declined moderately by 0.9%. Regarding the number of visitors, Georgia experienced an 8.8% increase in yearly terms. In October, inbound tourism recovered from the recent growth slowdown and showed a 7.8% growth y/y. The reported growth had a significant positive impact on projected real GDP, particularly due to the fact that remittances and income from tourism comprise an important part of households’ income in Georgia.

National and Foreign Currency Deposits

The other set of variables that have had a significant positive effect on our forecast were national and foreign currency deposits in commercial banks. Almost all types of deposits increased significantly both in yearly and monthly terms. In particular, the total volume of domestic currency deposits increased by 16.6% annually, while the total volume of foreign currency deposits went up by 18.0% compared to the same month of the previous year. Moreover, growth rates are still pronounced even after excluding the exchange rate effect. Deposit dollarization increased by 0.51 percentage points annually and 0.03 percentage points monthly. All deposit-related variables contributed positively to the growth forecast.

Inflation

In October, the annual inflation rate reached 6.9% , which is 3.9 percentage points higher than the medium-term target of 3% set for 2019-2021 by NBG. The main contributors to annual price increases were increased excise tax on tobacco and higher food prices, which contributed to annual inflation by 0.8 and 3.8 percentage points respectively. It is important to note that the excise tax hike can increase only the level of prices, not the inflation rate going forward (it is a one-time factor) and this effect is expected to be exhausted next year, while increased food prices, if sustained, can pose an inflation risk to the Georgian economy. Since food prices often fluctuate, it is important to also consider core inflation (inflation excluding the most volatile items, such as petroleum and food prices). Core inflation reached 3.4%, while annual inflation on imported goods reached 5.5% y/y.

Diving deeper into the reasons behind the rising price levels (excluding the already-mentioned excise on tobacco), we note the following:

First, in June-August of 2019, the lari depreciated with respect to Georgia’s main partner countries, which fueled expectations of further depreciation (these processes tend to have a self-fulfilling nature), and exacerbated the upward pressure on prices (since depreciation leads to an increase in imported product prices, which then raises the overall price level in the country). In October, the real effective exchange rate (REER) depreciated by 7.7% relative to the same month of the previous year, but appreciated by only 0.1% in monthly terms. Notably, the lari real exchange rate depreciated with respect to the national currencies of major trading partners in yearly terms. The lari/lira and lari/ruble real exchange rates both depreciated compared to the same month of the previous year by 12.4% (remained unchanged in monthly terms) and 9.8% (depreciated by 0.3% monthly) respectively. In addition, the lari real exchange rate experienced a notable annual depreciation against the US dollar and the euro (falling on average by 5.8% and 1.2% respectively y/y). The depreciation of the REER typically means that Georgian exports are cheaper for foreigners to buy, while imports become more expensive. In the very short run, however, real depreciation of the domestic currency can even decrease the overall value of exports. Eventually, however, REER depreciation will lead to the increased competitiveness of Georgian goods on international markets.

Secondly, world prices for food and agricultural products recently increased quite substantially, putting additional pressure on domestic prices. For example, the FAO food price index went up by 2.9%, 5.9% and 9.5% y/y in September, October, and November of 2019, respectively. Hence, the National Bank of Georgia increased the Monetary Policy Rate (MPR) twice in September — each time by 0.5 percentage points, then in October and December by 1 and 0.5 percentage points respectively. These measures, aimed at stemming inflation, also restrict borrowing and are expected to have a negative impact on the future growth rate.

Foreign Direct Investment and Expansionary Fiscal Policy

Foreign Direct Investment (FDI) recovered from a sharp decline in the second quarter of 2019. According to Geostat’s rapid estimate, FDI increased by 13.7% in annual terms in Q3 2019 and the main contributor to this high annual growth rate was reinvestment, which nearly doubled y/y.

Moreover, the government’s net cash outflow from investments in non-financial assets (i.e. the government’s capital expenditure) increased by 106.4% y/y in October alone, while the same figure for the last ten months of 2019 was 71.2%. Recovered FDI and government capital spending variables are not yet reflected in the forecast, but they could potentially have a positive impact on real GDP growth going forward.

Our forecasting model is based on the Leading Economic Indicator (LEI) methodology developed by the New Economic School, Moscow, Russia. We constructed a dynamic model of the Georgian economy, which assumes that all economic variables, including GDP itself, are driven by a small number of factors that can be extracted from the data well before the GDP growth estimates are published. For each quarter, ISET-PI produces five consecutive monthly forecasts (or “vintages”), which increase in precision as time goes on. Our first forecast (the 1st vintage) is available about five months before the end of the quarter in question. The last forecast (the 5th vintage) is published in the first month of the next quarter.

By Davit Keshelava and Yasya Babych