Regional Impacts of COVID-19 Shock to HoReCa Sector

The outbreak of the virus and the corresponding containment measures have started to severely affect the global economy. The Organization for Economic Co-operation and Development (OECD), in its Interim Economic Outlook Report (2020) on March 2nd downgraded 2020 real GDP growth projections for almost every country. The largest reduction in growth projections is seen for China (-0.8 percentage points) with worldwide real GDP growth expected to decline from 2.9% (November 2019 forecast) to 2.4%. In their report on March 6th, Asian Development Bank (ADB) estimated up to a 0.4 percent fall in world GDP due to the COVID-19 virus. Just like the OECD, the ADB also emphasizes the impact coming from China, where the virus was concentrated at that time.

Meanwhile, as the situation in Europe and the United States is worsening day by day, forecasts of Global GDP are being downgraded significantly. “The outlook for global growth: for 2020 it is negative—a recession at least as bad as during the global financial crisis or worse” was noted by the International Monetary Fund Managing Director Kristalina Georgieva in her statement on March 23rd 2020 following a G20 Ministerial Call on the Coronavirus Emergency. To summarize, there seems to be a consensus today that the scale of the economic and financial impact of the coronavirus may well be unprecedented and will depend highly on the management of the virus outbreak.

According to the above-mentioned OECD report, COVID-19 will impact economies via both supply and demand channels, as well as through containment measures, such as quarantines, restrictions on travel, and closures of public places.

Though international and local organizations are forecasting the economic outcomes of coronavirus, high uncertainty still exists surrounding this topic. In this blog, we will NOT try to estimate the extent of economic contraction in Georgia, we will rather focus on the shock that is expected to hit Georgia’s HoReCa (Hotels, Restaurants, Cafes) sector, see how its contraction will affect other industries in the short-term, and assess the distribution of the combined impact across regions of Georgia.

We focused on the Accommodation and Food Services (HoReCa) industry for the following reasons: firstly, containment measures like travel bans, along with increasing fear of climbing numbers of coronavirus incidents throughout the world, have a direct effect on international tourism inflows, which immediately impact hotels, restaurants, and cafes along with tourist destinations, resorts, and various entertainment services; domestic tourism also adds to all of the above. Secondly, apart from tourism, the HoReCa sector in Georgia is being affected by the government regulations on COVID-19 precautionary measures and subsequent declining local demand. Along with the announcement of the state of emergency on March 21, to limit the chances of exposure to the infection, the government has imposed restrictions on public gatherings and activities of restaurants, trade centers, public transport, sport and spa facilities, and cultural and sport events. Shops and trade centers are closing for an indefinite period, restaurants have recommendations to close down all operations that involve contact with people and only work through delivery services, and many hotels are choosing to close down for some period, even though they do not yet face official bans. The effects of coronavirus on the Georgian HoReCa sector are already quite visible: according to the March report by TBC Capital, payments with TBC Bank terminals in hotels have decreased by 40% compared to the previous year; moreover, payments in food service facilities by residents and non-residents have also gone down significantly .

A shock to the given sector initially causes the level of output in that particular industry to change. This is just an immediate reaction to the shock by producers. A direct consequence of changes in the industry’s output is the adjustment of demand for inputs that are used in the production process of this particular industry. With these changes in intermediate input requirements, one can evaluate the impact of a shock, not only on accommodation and food service activities but on other industries in an economy as well. To observe these effects, we used Supply and Use Tables (SUTs) for 2018 provided by the National Statistics Office of Georgia (GeoStat). This blog also analyzes how the effects of a shock will be distributed throughout the regions of Georgia and which industries will contribute to the economic reduction in each region. The illustration below summarizes this analysis.

First of all, we start with a hypothetical negative shock to the HoReCa industry of 1 billion GEL, which equals to about 27% of total annual output in this sector. The accommodation and food service industry uses many different inputs in their production process, in fact, they use inputs/products from almost every other industry in the economy, including their own. Therefore, when demand decreases for services in the HoReCa industry, other sectors also decrease their production, since their product is now less needed as an intermediate good. While there will be second and subsequent rounds of production reductions related to further changes in input requirements in economic industries linked with the HoReCa sector, it should be noted that we focus on measuring only the direct effects of the shock capturing the immediate responses in the first round of production processes.

As inputs from the (1) manufacturing, (2) real estate services, (3) electricity, gas, steam and air conditioning and (4) agriculture, forestry and fishing industries are used the most in the HoReCa sector as intermediate goods (see Illustration 2), these sectors will take the biggest consequential hit. Overall, we estimate that a 1 billion GEL shock to revenues in the HoReCa sector will have an additional negative impact of 400 million GEL through the direct input use channel.

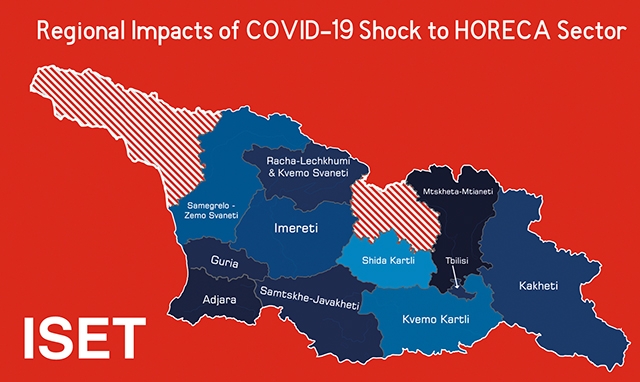

Further, we looked at the impacts on the regional level. Based on the distribution of economic activity, we investigate the impact of decline in HoReCa and other sectors across different regions of Georgia (See Illustration 2).

As we see, the biggest hit is to the Mtskheta-Mtianeti and Adjara regions, where total output is expected to decline from 2.5 to 3.5%, followed by the Guria, Tbilisi, Racha and Samtskhe-Javakheti regions with expected reduction from 1.5 to 2.5%. The relatively lower negative impact, from 0.5 to 1.5% of total output, is expected in the Kakheti, Imereti, Samegrelo, Kvemo Kartli, and Shida Kartli regions.

Since the shock is directed at the HoReCa sector, in all regions, with the exception of Kvemo Kartli and Shida Kartli, a reduction in total output is driven by this industry, comprising more than 50% of total reduction in value added. Table 1 below presents sectors that are the first and the second biggest contributors to the decline in value added in each region.

The table above demonstrates that the HoReCa sector plays most significant role in the reduction of value added in Adjara Region, followed by Tbilisi and Mtskheta-Mtianeti. Moreover, as we observe, the biggest contributors, besides HoReCa are the industries which comprise the most substantial part of intermediate inputs for the HoReCa sector (see Illustration 2).

To summarize, when analyzing the economic effects of coronavirus on the economy, it is important to have different channels of impact in mind. Considering the shock to the tourism industry and the containment measures implemented by the Georgian government, the accommodation and food service industry will be hit the hardest, with negative spillover effects becoming evident across most other sectors. In this blog, we tried to assess how a shock to the HoReCa sector is amplified in the short run and how the impacts are distributed regionally. We find that a hypothetical 1 billion GEL shock to the HoReCa industry in the short run will lead to an additional 400 million GEL drop in the output of the Georgian economy, with Mtskheta-Mtianeti and Adjara being affected the most.

By Ana Burduli, Mariam Katsadze, and Giorgi Papava