Azerbaijan – In Need of a New Growth Model

In 2015, falling oil prices challenged Azerbaijan’s growth model, which had been heavily oil revenue-financed, particularly through construction and trade in non-oil sectors. A strong local currency, again supported by oil-related inflows, had been another characteristic of the economy, contributing to banking sector stability, low dollarization, and improved welfare. These “givens” were shattered in 2015, forcing Azerbaijan to enter the uncharted territories of low oil prices, low public expenditure, currency fluctuations, and monetary tightening. As a result, growth slowed to 1.1% in 2015 and contracted 3.3% y/y in January 2016. With these challenges, Azerbaijan’s growth prospects have worsened, necessitating a new growth model. We believe that the massive capital expenditure seen in previous years has created added capacity, but it is probably underutilized. Utilizing this capacity, particularly through foreign participation, may be one of the sources of growth.

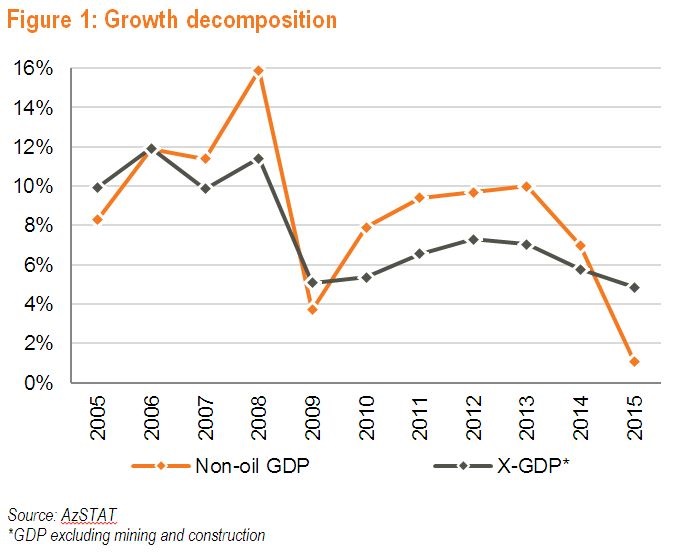

From 2010 to 2014, Azerbaijan’s growth was mainly driven by non-oil GDP, while oil GDP contracted by 2.9% per annum on average. The data indicate that non-oil GDP growth was fed by the booming construction and trade activity. Over the five years to 2014, non-oil GDP grew by a strong 8.8% per annum. Our calculations indicate that 37.1% of this growth was driven by construction, with average annual growth of 18.2% over the five years. However, infrastructure improvements that resulted from this construction boom were probably not fully utilized, as the oil sector dominated revenue generation. Trade activity contributed another 10.0%. Together, trade and construction sectors accounted for almost half of the non-oil GDP growth from 2010 to 2014.

In 2015, however, the Azerbaijani economy grew 1.1% in real terms – the lowest level since 2011. Unlike previous years, oil and gas GDP increased more than non-oil GDP, with the latter posting 1.1% growth – the lowest level since records of non-oil GDP began in 2000. This weak non-oil performance was mainly due to the 13.4% contraction in the construction sector and the 1.7% decline in transport and storage. Trade activity continued to feed growth, along with manufacturing and the rebound in agriculture.

Based on this information, we can conclude that construction was at the center of Azerbaijan’s growth model from 2010–2014. These five boom years in the sector have probably improved the country’s infrastructure, which had been in considerable disrepair since the early 1990s. However, the investment data indicate that most of this construction (72.6%) was financed from the public purse, which itself was 70% funded by oil revenues, thereby making it dependent on oil prices.

Following the collapse of the oil price, the Azerbaijani government slashed its expenditure, particularly capital investments. The construction sector, which had continued to boom until mid-2015, suddenly ran out of new projects, eventually finishing 2015 with a 13.4% contraction. Other sectors have been much less affected and have generally been less volatile. For example, excluding mining and construction, the GDP growth rate in 2015 was 4.9%, down from 5.8% in 2014.

Along with construction, another driver of growth – trade – is also expected to be hurt by low oil prices. It appears that following the first AZN devaluation in February 2015, people rushed to exchange their devalued currency for goods whose prices were relatively stable, as long as shops and distributors were tapping their stocks. However, anecdotal evidence suggests that activity declined following the second AZN devaluation in December 2015 as stocks were almost depleted. Prices increased relatively quickly, with the annual inflation rate jumping from 3.7% in November 2015 to 7.7% in December 2015 and 13.7% in January 2016. According to the latest data, trade activity slowed to 4.3% y/y in January 2016, down from 10.9% y/y in 2015.

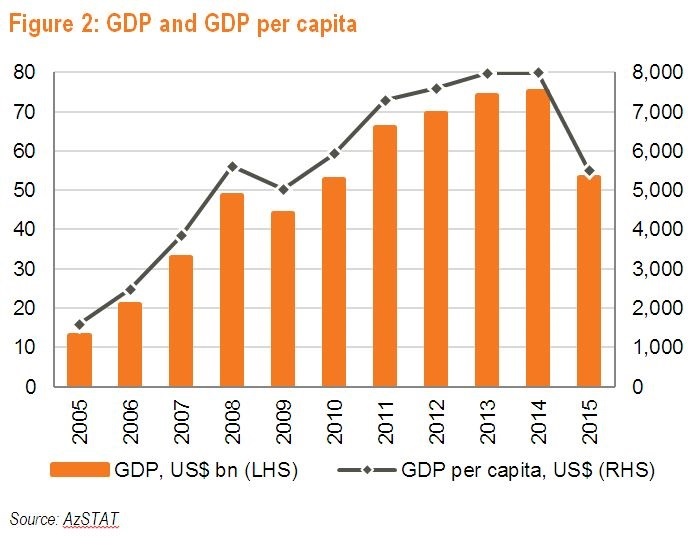

Two devaluations in 2015, themselves triggered by persistent low oil prices, resulted in a 29.2% fall in nominal GDP in US$ terms to US$ 53.3mn in 2015, and GDP per capita contracted 31.3% to US$ 5,493 – its pre-2010 level.

Fiscal sustainability in the low oil price environment required budget cuts. Government acknowledged this need by cutting capital spending which was reduced from over AZN 8.0bn (above US$ 10.0bn) in previous years to AZN 4.6bn (US$ 2.9bn) in 2016. As a result, an important source of funding for construction, trade and other sectors has shrank, with a negative impact on potential overall growth rate, which is forecast to remain in the low single digits. At the same time, monetary tightening undermines any prospect of investment financing from the domestic banking sector, leaving foreign investment as the best alternative for growth financing.

In this setting, efficient utilization of idle capacity is an important source of growth. Massive capital expenditure in previous years, particularly investments in infrastructure, has probably expanded Azerbaijan’s potential economic output. However, the booming oil sector has been relegating this potential to second place. The Azerbaijani authorities now need to develop policies to utilize this capacity, particularly by attracting foreign investment and know-how. This could be achieved by welcoming foreign banks. Through competition and by bringing in foreign capital, these banks can take financial intermediation to a new level that will assure the efficient utilization of investments. Foreign banking finance is particularly promising given that at 24.5% of GDP, corporate loans in Azerbaijan are low by international standards, leaving scope for expansion.

Anecdotal evidence suggests that during Azerbaijan’s rapid development phase, project finance in the country was generally done directly, bypassing bank intermediation. This has probably resulted in some inefficiency. It was bearable given the need for rapid implementation and available revenue flow thanks to high oil prices. Now Azerbaijan needs to change gears, as the revenue inflows have decreased, exposing the need to secure alternative financing sources besides public funding and concentrate on efficient allocation of funding. Financial enterprises, specifically banks, are important entities in this respect. Banks, particularly international ones, have solid experience in attaining efficiency of capital allocation in the economy. They not only provide loans, but also “supervise” project development, assuring that projects are completed. Moreover, international banks can secure the necessary capital from abroad – a vital detail for Azerbaijan, given the low oil revenues.

To summarize, growth expectations in Azerbaijan can be improved, once the business environment is reformed and welcoming to foreign participation. Subsequently, FDI can leverage idle capacity to generate new growth, in place of the past reliance on the publicly financed construction sector.

Alim Hasanov (Galt and Taggart)