Electricity Market Watch

Sector research is one of the key directions of Galt & Taggart Research. We currently provide coverage of Energy, Healthcare, Tourism, Agriculture, Real Estate, and Wine sectors in Georgia. As part of our energy sector coverage, we produce a monthly Electricity Market Watch, adapted here for Georgia Today’s readers. Previous reports on the sector can be found on Galt & Taggart’s website - gtresearch.ge.

Another thermal power plant project up for open tender

The construction of a second combined-cycle power plant is expected to commence in 2017. The 240MW power plant will replicate the technical characteristics of Gardabani CCPP, which commenced operations in September 2015. Gardabani CCPP II construction costs are estimated at US$ 160.0mn. According to GOGC, the owner of both projects, six international companies participated in the Expression of Interest stage for Gardabani CCPP II, but their identities are not public yet. Gardabani CCPP was built by Turkish Calik Enerji Holding.

Inter Rao intends to sell its generation assets

Inter Rao has declared intent to sell the generation assets under its ownership – Mtkvari Energy, blocks 9 and 10 in Gardabani. Generation unit 9, with an installed capacity of 300MW, is the only one currently functioning. It acts as a guaranteed capacity source and supplies electricity mainly to the greater Tbilisi area (Telasi subscribers). The grid (Telasi) is not up for sale. The news has been confirmed by the Deputy Minister of Energy of Georgia and the Chairman of Inter Rao, Boris Kovalchuk. A likely buyer is GIG, which already owns 362MW of generation assets, including a 300MW natural-gas fired TPP, small hydro plants, and a 13MW coal TPP, for which it mines its own coal. Recently, GIG signed an MoU to construct another coal TPP in Tkibuli, with an installed capacity of 150MW. Successful acquisition of Mtkvari Energy and construction of Tkibuli-150 TPP would make GIG the owner of one-fifth of Georgia’s total installed capacity.

Turkish investor interest in the Georgian energy sector remains strong

Calik Enerji Holding has expressed interest in building another thermal power plant with GE power, the owner of a 110MW TPP. Calik is also considering the potential of wind power plants to be located in Shida Kartli and Imereti regions, where wind towers have already been installed to monitor wind conditions over a 1-year period. Meanwhile, the official agreement between Georgian and Turkish governments was ratified by the Turkish Parliament, further fostering the energy sector cooperation between Georgia and Turkey.

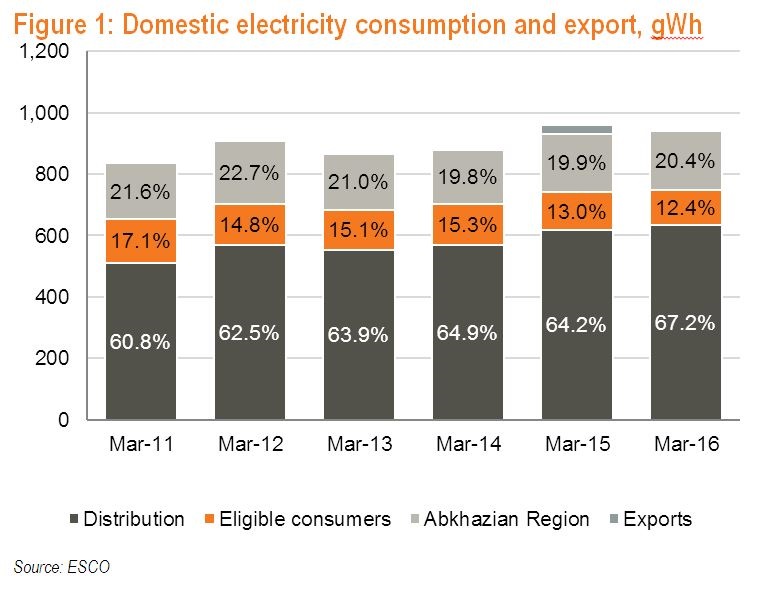

Domestic consumption growth decelerates in March

Domestic electricity consumption was up 1.0% y/y in March 2016 and 1.8% y/y in 1Q16. Weaker growth was partly due to the high base in March 2015 and warmer weather compared to March of last year. Distribution network operators are a major consumption group, servicing residential and commercial customers. Their consumption growth rate decelerated to 2.7% y/y in March 2016. Consumption in the greater Tbilisi area grew 5.8% y/y, while growth in the regions was weaker (1.2% y/y). Consumption by eligible consumers (large industrial customers who purchase directly from ESCO and the generation entities) was down 6.7% y/y in March 2016, as Georgian Manganese, representing 81.0% of direct consumption, further reduced its consumption.

Cheap imports from Russia bridge electricity deficit

In March 2016, domestic generation was down 9.5% y/y on the back of lower TPP output, leading to higher imports from Russia. The amount of TPP-generated electricity decreased 56.2% y/y. Tbilsresi generation was down 98.7% y/y, while Mtkvari halted production in March 2016, as Inter Rao is negotiating the sale. We expect generation to resume once the transaction is finalized. HPP output was up 17.1% y/y in March 2016, on the back of increased generation by deregulated HPPs (+41.0% y/y) and regulated seasonal HPPs (+26.5% y/y). Enguri and Vardnili production was down 5.7% y/y due to weather conditions and low water levels in the reservoir.

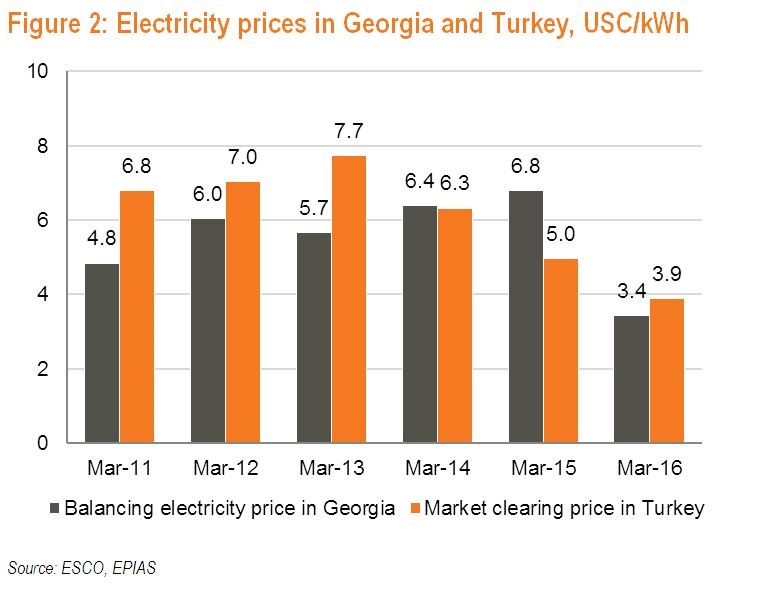

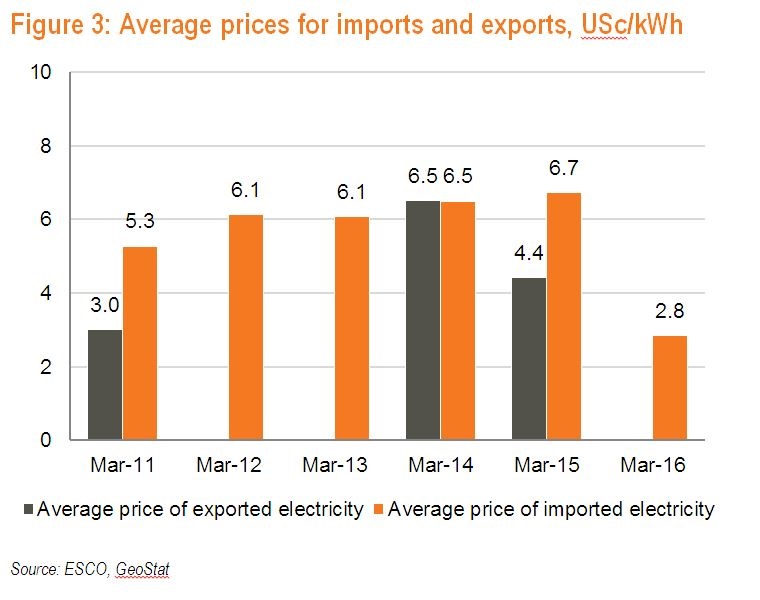

The drop in domestic generation was compensated by Russian electricity imports, up 76.2% y/y in March 2016. As a result of a short-term deal with Russia for discounted electricity imports in February, the balancing electricity price in Georgia was cut in half to USc 3.4/kWh compared to last year. The market clearing price of electricity in Turkey was down 21.5% y/y to USc 3.9/kWh, as the downward trend of the past few months persists. The prices are expected to remain low in the short term on the back of lower commodity prices.

Tamara Kurdadze (Galt and Taggart)