Reforms in Azerbaijan: To Be or Not To Be?

Azerbaijan’s economy contracted 3.5% y/y in 1Q16 as construction and transportation sectors declined a respective 32.5% y/y and 14.5% y/y. Growth in trade (+3.4% y/y) and manufacturing (+5.7% y/y) eased the downward pressure. Oil and gas extraction picked up, boosting oil GDP slightly (+0.8% y/y), while non-oil GDP contracted 5.7% y/y. A contraction is expected in 2Q16, followed by a relatively flat performance in the second half of 2016 as the high base factor subsides.

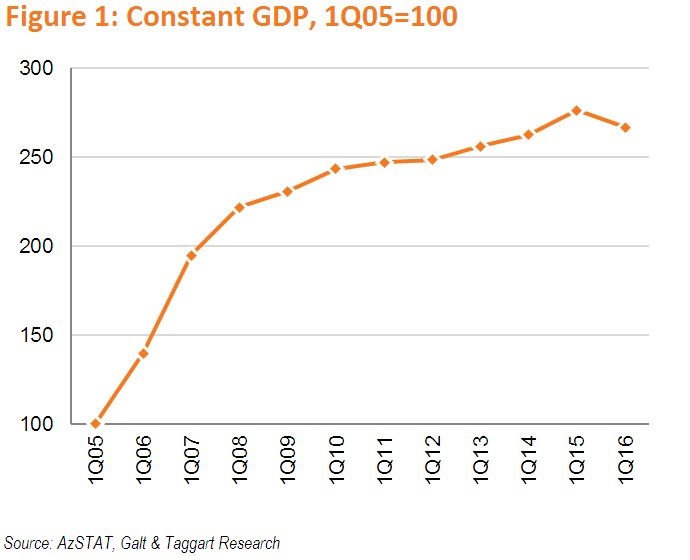

It is worth mentioning that following 1.9% average annual growth in the first quarter from 2011 to 2014, Azerbaijan’s GDP expanded by 5.3% in 1Q15, resulting in a high base for the current year. Calculations indicate that despite the contraction in 1Q16, GDP in constant terms is still higher than in 1Q14 (+1.6%). Therefore, we can assume that part of the explanation for falling GDP is a correction from the high base of the previous year.

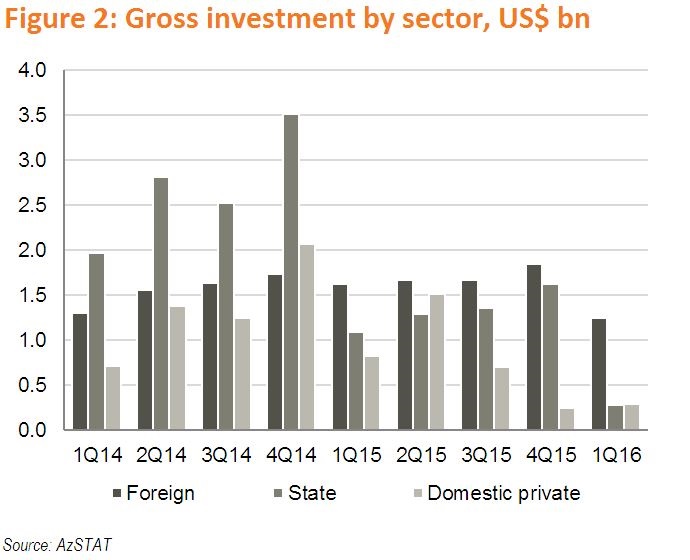

Aside from the retrospective factors, the key challenges were rooted in falling investments, which can be explained by two devaluations in 2015 and bleak prospects, as reforms introduced in 2015 take time to yield tangible results. Azerbaijan’s growth model over the previous years was based on public investment feeding double digit growth rates in construction and providing employment for low-skilled labor. From 2007 to 2015, the public sector accounted for 77.4% of total domestic investment. The model can be roughly summarized as follows: the financing (investment) was provided by the state, while the private sector implemented projects (acting as a client). While the need to improve domestic infrastructure justified this model, availability of oil revenues meant that the model was only sustainable as long as oil prices remained elevated.

As oil prices collapsed and associated revenues fell significantly, the Azerbaijan growth model became unsustainable. The authorities could have continued this model for some more years with the resources available, but preference was given to long-term fiscal sustainability, which called for cuts in public expenditure. Public capital spending was slashed by 57.4% y/y in 1Q16, which helped bring the budget back to surplus territory. Given the 1Q16 result and higher-than-budgeted oil prices, the annual consolidated budget deficit will likely be in lower single digit levels compared to the double digit figures put forward in the official budget document.

Ideally, falling public investment should have been offset by increasing private sector investment to retain growth momentum. However, concerns related with future prospects have hindered private investment. Anecdotal evidence related to problems in the banking sector suggests that even if prospects improve, the private sector might face challenges in finding financing sources. Addressing this dual challenge should be a priority for Azerbaijan.

This can be achieved by re-designing the economic growth model from public sector-led to private sector-led growth. A conservative fiscal policy was one step in this direction, as it removed the “crowding out” effect of private sector investment by the public sector. The next stage should be structural reforms that address the concerns of the private sector and yield rapid and tangible results. Guaranteeing access to finance should be an important component of these reform packages. This can easily be achieved by welcoming foreign financial entities to Azerbaijan, who in turn can bring cheaper foreign financing and improve competition in Azerbaijan’s banking sector.

The recent pick-up in oil price, up by more than 68.0% from the January dip, is definitely a positive development for Azerbaijan. However, this blessing should be digested with care and should not result in a return to the previous model. Preference should be given to saving additional revenue rather than channeling it into public capex. High reserve buffers will support Azerbaijan’s credit ratings and make it an attractive destination for foreign investment. At the same time, higher oil prices and the current level of money supply will support the current exchange rate, thereby removing another “concern” hindering investments.

To sum up, Azerbaijan has probably passed the low point of the oil price crisis and settled at the new, albeit low, equilibrium. Further growth should be achieved through reforms that attract private and preferably foreign investment.

Alim Hasanov (Galt and Taggart)