Electricity Market Watch

Sector research is one of the key directions of Galt & Taggart Research. We currently provide coverage of Energy, Healthcare, Tourism, Agriculture, Wine, and Real Estate sectors in Georgia. As part of our energy sector coverage, we produce a monthly Electricity Market Watch, adapted here for Georgia Today’s readers. Previous reports on the sector can be found on Galt & Taggart’s website - gtresearch.ge.

BGEO Group PLC announces the purchase of the remaining 75% stake in GGU

JSC BGEO Investments, a BGEO Group subsidiary, has signed a Share Purchase Agreement to acquire a 75% equity stake in Georgian Global Utilities Limited (GGU), the parent company of Georgian Water and Power (GWP). As a result of this buyout, BGEO Group will own 100% of GGU. The transaction values GGU’s enterprise value at GEL 287.5mn. BGEO Investments will pay a cash consideration of US$ 70mn (c.GEL 152.6mn) for the 75% stake in GGU. GGU supplies water and provides wastewater services to up to 1.4mn people in Tbilisi, Mtskheta, and Rustavi. In addition, GGU owns and operates three hydropower generation facilities with a total installed capacity 143 MW.

Georgia’s accession to the Energy Community

Negotiations for Georgia’s accession to the European Energy Community (EC) have concluded, according to the Deputy Minister of Energy, Mariam Valishvili. The next step in the process is a discussion of the matter at the EC Council of Ministers in autumn 2016. If membership is approved, Georgia will have to make some changes to align its energy market practices with EU best practices, including changes in the tariff calculation methodology for electricity and natural gas supply, unbundling of generation and distribution, and a move toward a competitive electricity and natural gas market.

Khudoni HPP on hold until a new PPA policy is devised

The Khudoni HPP (702 MW) project has been put on hold by the government due to anticipated changes in Georgia’s PPA policy. The project, owned by Indian Transelectrica, was already facing difficulties and has yet to obtain a construction permit. Following the ministry’s announcement last month that Georgia will re-evaluate the existing PPA policy in accordance with IMF recommendations, government works on the Khudoni project from the government’s side are halted before the new policy is drafted.

Gazprom to deliver natural gas to a small distributor in Western Georgia

Gazprom signed a 100 million cubic meter (mmcm) delivery contract with a small natural gas distribution license holder, Gasko+. The contract was signed during the St. Petersburg International Economic Forum on June 16th and gas is to be delivered in July-December 2016. Gasko+ is a minor distribution licensee operating in Western Georgia. Notably, annual household consumption of natural gas in Georgia in 2015 amounted to 694 mmcm.

Partnership Fund to invest US$ 5mn in small and medium size HPP development

Partnership Fund intends to invest US$ 5mn in the Caucasus Clean Energy Fund (CCEF). CCEF was launched in June 2015 by a US private equity firm, Schulze Global Investments, and is anchored by EIB, GEEREF and Austrian OeEB, according to company sources. The MoU was signed by Schulze Global Investments and the Partnership Fund on June 17th, 2016. CCEF is committed to investing in small and medium-sized HPPs in Georgia and has a target to raise US$ 100mn.

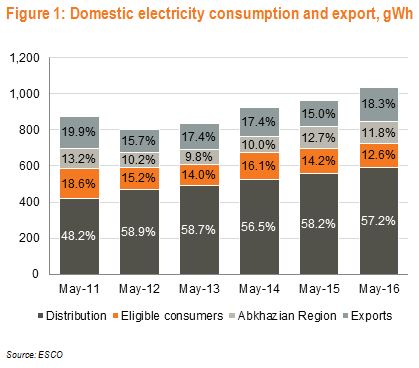

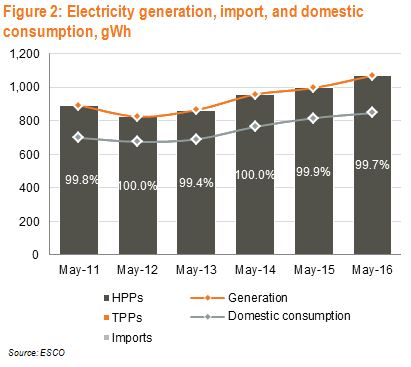

Domestic consumption needs fully met by domestic hydrogeneration

Domestic electricity consumption was up 3.8% y/y in May 2016. The Abkhazian region’s consumption remains subdued, with only 1.0% y/y growth in May 2016, albeit from the high base of May 2015 (+31.5% y/y). Excluding the Abkhazian region, Georgia’s domestic consumption grew 6.2% y/y, with growth concentrated on the greater Tbilisi area (+11.6% y/y). Consumption by Energo-Pro subscribers was up 3.6% y/y and Kakheti Energy Distribution (KED) subscriber usage was up 1.4% y/y. Consumption by Georgian Manganese, the largest eligible consumer, was flat in May 2016, making up 12.5% of domestic consumption. Domestic consumption needs were fully met by domestic hydrogeneration in May 2016. Electricity generation by Enguri and Vardnili made up 50% of total consumption.

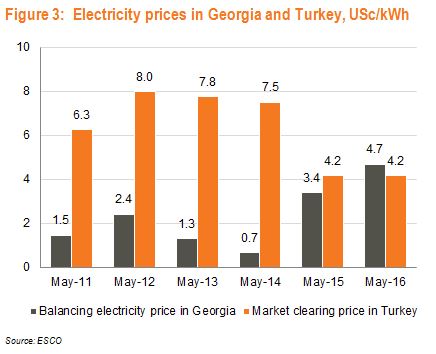

Electricity exports in May 2016 were up 32.0% y/y to 189.9 gWh, with 81.7 gWh going to Russia, 61.0 gWh to Turkey, and 45.2 gWh to Armenia. The average export price of Georgian electricity was USc 3.3/kWh, still competitive in comparison with Turkey’s market price of USc 4.2/kWh.

Electricity prices in Turkey and Georgia

The weighted average market clearing price in Turkey was flat y/y in US$ terms, but increased 10.5% y/y in TRY terms. In Georgia, the balancing electricity price increased 37.9% y/y to USc 4.7/kWh. However, the wholesale price of electricity in May is not representative of the market, as a mere 1.7% of total electricity supplied to the grid was traded through the market operator. The rest of the trade occurred through bilateral contracts.

Tamara Kurdadze (Galt and Taggart)