Electricity Market Watch

Sector research is one of the key directions of Galt & Taggart Research. We currently provide coverage of Energy, Healthcare, Tourism, Agriculture, Wine, and Real Estate sectors in Georgia. As part of our energy sector coverage, we produce a monthly Electricity Market Watch, adapted here for Georgia Today’s readers. Previous reports on the sector can be found on Galt & Taggart’s website - gtresearch.ge.

Ministry of Energy’s preliminary 2017 budget set at GEL 121mn

Ministry of Energy will be allocated GEL 121mn (-10.4% y/y) according to the 2017 draft budget. 74.4% of total, GEL 90mn (~US$ 40mn), will go to the construction and rehabilitation of strategically important transmission infrastructure. According to the draft budget, transmission infrastructure development is to be financed through debt from IFIs. One of the largest projects planned for 2017 in terms of project cost is the 220 kV Akhaltsikhe-Batumi transmission line, with an estimated cost of GEL 45.6mn (~US$ 20mn), financed by the World Bank. Notably, the budget is preliminary and subject to revision.

Minister of Energy resigns, leaving his deputy as the successor

Mr. Kakha Kaladze resigned from his post as the Minister of Energy, leaving Mr. Ilia Eloshvili as his successor. Georgian law requires all state ministers, except the Prime Minister, to step down from active duty if they are running for parliament in the elections. Campaigning with the Georgian Dream, Mr. Kaladze could no longer hold his ministerial post. Mr. Eloshvili has been with the Ministry since 2012, serving as the Deputy Minister of Energy.

New Service Quality Rules aim to incentivize higher quality service provision by utilities

The regulator aims to incentivize service quality improvement by gas, electricity, and water utilities. The newly adopted Service Quality Rules (“the Rules”) provide quality standards for utilities and will go into force on January 1, 2017. The Rules dictate standard response times to customer complaints and requests. They also require notifying subscribers about planned service interruptions and outline a clear timeframe for handling unplanned outages. When a utility company cannot resolve an unplanned outage in less than 12 hours, it must submit a detailed explanation to the commission. If customer complaints/requests are not satisfied within a specified timeframe, the customers are automatically reimbursed according to common standards. The Rules reward utilities that deliver superior performance across three pillars – out-of-service notifications, handling unplanned outages, and timely response at the utility call center – by increasing their regulatory cost base, which translates into increased revenue for the utilities.

Gardabani-2 CCPP contracted to commence operations in 2020

Agreements were signed at the end of September for the development of the 230 MW Gardabani-2 CCTP. An implementation agreement was signed by Gardabani Thermal Power Plant-2, GOGC, and ESCO. An EPC agreement was signed by Gardabani Thermal Power Plant-2 and China Tianchen Engineering Corporation (TCC). Construction of the CCTP will be funded by equity from GOGC and debt from Chinese banks, with negotiations on bank financing still ongoing, according to GOGC. The debt will be issued to the Gardabani Thermal Power Plant-2 SPV (fully owned by GOGC). The plant is expected to be commissioned in 2020.

Additional 320.1 MW of installed capacity expected to come online by early 2017

A total of 320.1 MW of installed capacity is expected to come online by early 2017. The 4.4 MW Saguramo HPP hit the grid mid-September. Next in line is the 20.7 MW Qartli WPP, expected to commence operations in test regime by the end of October. Total project cost amounted to US$ 30mn, with US$ 24mn financed through a loan from EBRD. Qartli WPP has a 10-year, 12-month guaranteed PPA with ESCO at a purchase price of USc 6.89/kWh. 108 MW Dariali and 187 MW Shuakhevi HPPs are expected to be commissioned shortly thereafter. Dariali HPP has a guaranteed off-take tariff of USc 6.5/kWh November through April for a period of 10 years. The terms of the Shuakhevi PPA remain confidential. While all newly built HPPs have priority access to cross-border transmission lines, the current summer capacity is already allocated to Paravani. If the 320 MW of new installed capacity hits the grid as expected in 2017 and generators decide to export to Turkey, the capped export capacity will become a constraint, unless the cap is removed by the Turkish side.

Ksani substation rehabilitation completed by Siemens Austria

The rehabilitation of one of Georgia’s strategically important substations, the Ksani SS, has been completed by Siemens Austria. The project cost EUR 9.9mn and was debt-financed by ADB. Ksani SS is key to strengthening the national grid, as it is one of the main 500/220 kV substations servicing high and medium voltage lines, including Kartli-1 (Ksani-Gardabani), Kartli-2 (Zestaponi-Ksani), and Mukhrani (Ksani-Marneuli) 500 kV overhead lines.

Agreement to incentivize trans-border electricity trade between Turkey and Georgia goes into effect

A 20-year intergovernmental agreement between Turkey and Georgia in the energy sector went into effect in September 2016. The agreement envisages collaboration towards advancing the regional electricity market, including enhanced trans-border infrastructure (400 kV Akhaltsikhe-Tortum and 150 kV Batumi-Muratli), sharing of experience, and promotion of green energy. The working group that was created under the charter is supposed to develop an action plan by the end of 2016. The action plan will include a detailed roadmap on how Turkey and Georgia will develop the necessary trans-border infrastructure to enhance trade potential and facilitate development of longer term international off-take agreements that would be in compliance with ENTSO-E standards. Georgia and Turkey also plan to coordinate efforts on synchronizing Georgia’s export capacity auctions.

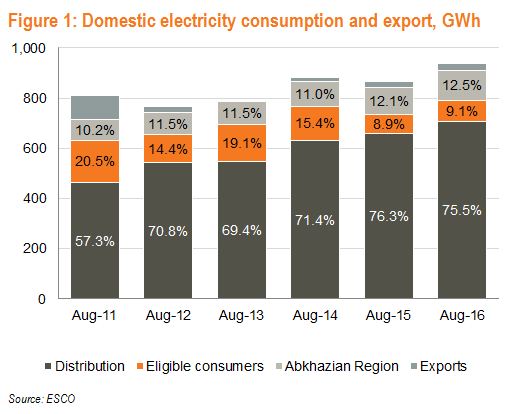

Tbilisi consumption remains the leading driver of domestic electricity consumption growth

Domestic consumption increased 8.1% y/y in August 2016, with DNOs being the major growth drivers. DNO consumption increased 7.2% y/y, with the greater Tbilisi area (Telasi subscribers) posting an outsized 22.3% y/y growth rate. Usage of Energo-Pro subscribers was flat (+0.3% y/y), while Kakheti Energy Distribution usage was up 6.4% y/y. Consumption of eligible consumers was up 11.3% y/y, albeit from a very low base in August 2015 (-53.6% y/y). Consumption of Georgian Manganese drove the growth, with consumption up 25.3% y/y. Notably, GM’s consumption is still 41.9% lower than the August 2014 level. Consumption of the Abkhazian region was up 12.9% y/y. Electricity exports increased 13.3% y/y in August 2016, with Turkey the only importer. According to the data from GCAT (GSE capacity auction), the entire export capacity was allocated to Georgia Urban Energy (Paravani HPP). In addition to exports, a significant amount of electricity transit (138.7 GWh) took place from Azerbaijan to Turkey. Transit fees go to GSE, the transmission system operator.

Domestic electricity demand met almost entirely with hydrogeneration

Domestic consumption needs were met almost entirely by domestic hydrogeneration in August 2016. Total generation was up 11.0% y/y, with generation by Enguri and Vardnili up 16.3% y/y and other regulated HPPs up 19.9% y/y. Generation by deregulated HPPs increased 5.6% y/y. TPP generation in July 2016 was down 33.9% y/y, as hydrogeneration was enough to meet the increased demand in the grid. 76.0% of TPP-generated electricity was provided by Gardabani CCPP (USc 2.8/kWh) and the rest by G-Power (USc 3.7/kWh). Gardabani CCPP also provided guaranteed capacity for all of August (31 days), along with Unit 3 (31 days) and Unit 4 (2 days). Unit 9 and G-Power, on the other hand, had no stand-by days in August. The guaranteed capacity fee increased 361.3% y/y to USc 0.71/kWh.

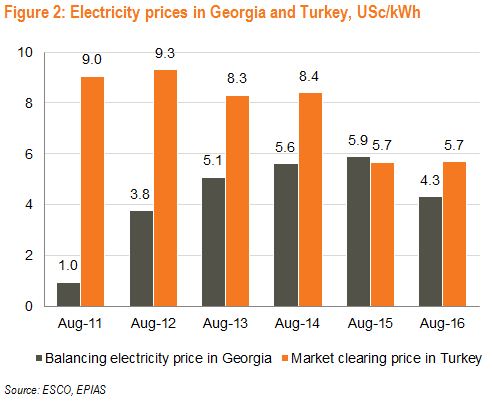

Turkish electricity prices flat compared to August 2015

Market clearing prices in Turkey were flat compared to August 2015. The weighted average wholesale price in Georgia was at USc 4.3/kWh (-26.7% y/y), while the Turkish market clearing price was at USc 5.7/kWh. 3.2% of total electricity supplied to the grid was traded through the market operator, with the rest was traded through bilateral contracts. Import prices decreased 18.2% y/y to USc 5.2/kWh, with 100% of imports (10.5 GWh) coming from Azerbaijan.

Tamara Kurdadze (Galt and Taggart)