Electricity Market Watch

January 10, 2017

For Georgia Today by Mariam Chakhvashvili

Sector research is one of the key directions of Galt & Taggart Research. We currently provide coverage of Energy, Healthcare, Tourism, Agriculture, Wine, and Real Estate sectors in Georgia. As part of our energy sector coverage, we produce a monthly Electricity Market Watch, adapted here for Georgia Today’s readers. Previous reports on the sector can be found on Galt & Taggart’s website - gtresearch.ge.

New Year - new tariffs. GNERC has announced new tariffs for certain HPPs and TPPs, as well as for commercial users of Telasi and Energo-Pro; residential tariffs remain unchanged in 2017. The new tariffs become effective on January 1, 2017.

Tariffs were revised for ten HPPs (all owned by Energo-Pro), which together accounted for 18.1% of total generation in 11M16. Only one of them got a tariff increase, while tariffs were lowered by 12.5%, on average, for the remainder. Enguri and Vardnili, the largest state owned HPPs, also saw their tariffs increase to 1.496 tetri/kWh (from 1.187 tetri) for Enguri and to 2.88 tetri/kWh (from 1.17 tetri) for Vardnili.

Tariffs were revised upward for all TPPs for the year 2017. Revisions varied from a 13.5% increase for the Gardabani CCGT to a 66.9% increase for GPower. The guaranteed capacity fee, received by TPPs for the number of days they are on standby, was decreased for Block 3 (-23.8%), Block 4 (-30.6%), and the Gardabani CCGT (-6.1%), while it was increased for Block 9 (+10.5%) and GPower (+1.4%).

Changes were applied to GSE and Energo-Trans tariffs as well. GSE is a transmission and dispatch licensee, while Energo-Trans (subsidiary of GSE) is only a transmission licensee. GSE was granted a 15.6% increase for transmission services, while its tariff for dispatch services was lowered by 16.3%. Energo-Trans saw its tariff lowered by 7.9% for the 500kv lines and increased by 71.0% for its 400kv lines. The latter is paid mainly by exporters, while the former three tariffs are payable by both consumers and exporters.

Despite all the changes on the regulated wholesale electricity market, household tariffs remain unchanged. The Telasi and Energo-Pro tariffs were increased insignificantly and only for commercial users connecting to high voltage lines (6kv and above).

The Ten Year Network Development Plan (TYNDP) 2017-2027 was approved by Ministry of Energy on December 15, 2016. TYNDP is to be updated on an annual basis, starting in 2015. This (third) edition of TYNDP features revised forecasts of electricity consumption growth and updated pipelines of power plant and transmission network projects. The annual consumption growth rate in the optimistic scenario is revised downward from 5.0% to 3.5%, which would result in 16.4tWh of electricity consumption in 2027. Expected commissioning dates for several large HPPs (Khudoni, Nenskra, Oni) have been pushed back, resulting in certain infrastructural projects also being postponed. Total investment over 2017-2027 is estimated at EUR 735.4mn, with 40% of that amount to be spent over the first three years.

EBRD has approved a US$ 5.5mn loan for the 17.2MW Lukhuni 2 HPP. Rustavi Group LLC is a special purpose vehicle (SPV) established for the sole purpose of constructing the HPP. Rustavi Group LLC is owned by Rusmetali Ltd (51%), a company registered in Georgia, and JSC Partnership Fund (49%). EBRD is providing a senior loan of up to US$ 5.5mn, partnering with TBC Bank on the project. Total investment cost of the project is estimated at US$ 26.4mn.

Tbilisi and Energo-Pro customers driving electricity consumption growth in November 2016

Domestic consumption increased 11.5% y/y in November 2016, with DNO consumption (+14.0% y/y) driving the growth. The greater Tbilisi area (Telasi subscribers) posted an outsized 21.5% y/y growth rate. Usage of Energo-Pro subscribers was up 10.3% y/y, while Kakheti Energy Distribution usage was up 5.9% y/y. Consumption of the Abkhazian region was up 10.4% y/y, following a 20.8% y/y increase in October 2016. Eligible consumer usage was down 4.3% y/y from an already very low base in November 2015 (-32.7% y/y). Consumption by Georgian Manganese, the largest direct consumer, was up 1.7% y/y from the November 2015 low base, while consumption by GWP, the second-largest direct consumer, declined 6.3% y/y.

Electricity exports were negligible in November 2016. A significant amount of electricity transit (131.5gWh) took place from Azerbaijan to Turkey.

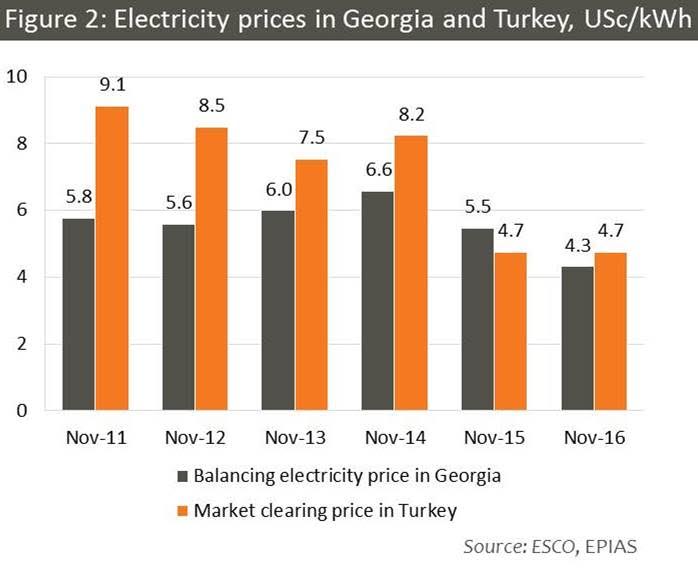

Domestic consumption needs met almost entirely by domestic generation

Imports accounted for a mere 1.3% of total electricity supplied to the grid in November 2016. The newly commissioned wind power plant generated 1.8gWh, accounting for 0.2% of total electricity supplied to the grid. Total generation increased 17.9% y/y, with HPP generation up 17.0% y/y and TPP generation up 18.9% y/y. The main drivers of the increase in hydro generation were Enguri and Vardnili (+43.3% y/y). Electricity imports in November 2016 were down 84.8% y/y to 12.7gWh, with 76.4% coming from Azerbaijan and the rest from Russia. Guaranteed capacity was provided by each of the five guaranteed capacity sources for most of the month. Mtkvari Energy and Gardabani CCGT operated at full power for the whole month, while Blocks 3 and 4 and GPower were mainly providing reserve for the system.

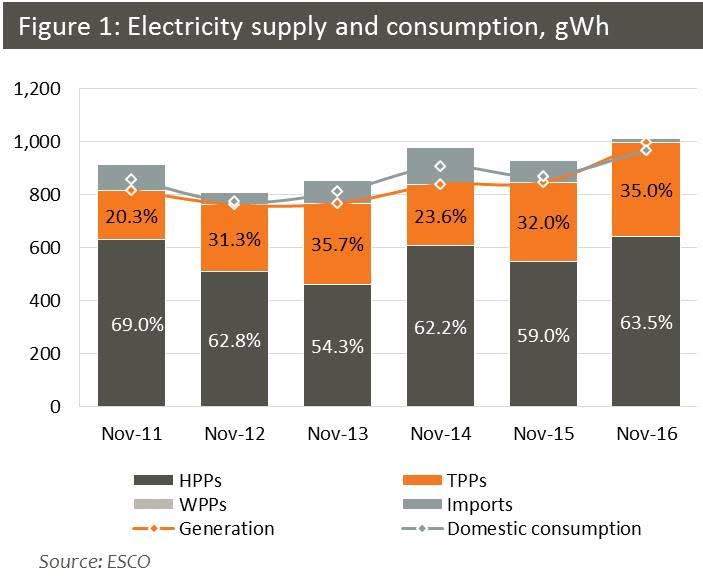

Wholesale electricity prices down in November 2016

Wholesale market prices in Georgia decreased 21.2% y/y to USc 4.3/kWh, 9.0% below the Turkish market clearing price in November 2016. Turkish electricity prices decreased 0.2% y/y to USc 4.7/kWh from a significantly low base in November). 16.2% of total electricity supplied to the grid in November 2016 was traded through the market operator, with the rest traded through bilateral contracts.