Russia May Lose 3rd of Turkey's Gas Market, but Will Get Revenge through Egypt

While Turkey is almost completely "sitting" on the Russian gas needle, Ankara is trying its best to diversify its energy consumption. The reduction of dependence on foreign resources and the country's transformation into the main gas hub of Europe have become the main goals of the new National Energy Program of Turkey. According to present forecasts, during its implementation, Russia will lose almost a third of its share in the local market of blue fuel due to exports from Azerbaijan. However, this scenario is gloomy for Moscow only at first glance.

The great energy "sultanate"

The Ministry of Energy of Turkey, in early April, headed by the department of Berat Albayrak, presented the National Energy Program: "not a revolution, but evolution," the first significant results of which will be achieved within the next 15 years. Saying this, the son-in-law of President Recep Tayyip Erdoğan emphasized that the main goal of the doctrine is to win the title of leading energy hub of the region and "to reduce Turkey's dependence on foreign resources."

Russia was not mentioned, but it is obvious that one of the main "victims" of the program implementation will be Moscow. According to the Turkish state monopoly Botas, the Russian Federation is leading in the gas import scheme of the country with a colossal share of 56%. Next comes Iran (19%), Azerbaijan (9%), Algeria (9%) and Nigeria (7%). However, Russia's dominance may come to an end in the foreseeable future.

According to analysts of the authoritative Institute of Energy Economics at the University of Cologne, during the 15 years specified in the Albaiar doctrine, the share of Gazprom in the Turkish market will drop to 38.9% (35.3 billion cubic meters per year). At the same time, due to the introduction of the TANAP pipeline, Azerbaijan will increase its weight by 34.8% (31.5 billion cubic meters).

"Turkey's total gas imports will grow from 54.1 billion cubic meters in 2017 to 90.5 in 2030," European analysts wrote. This volume takes into account not only the needs of Turkey itself, which will grow to 67.2 billion cubic meters, but also in the EU countries - primarily Greece and Bulgaria. By 2030, according to experts, Turkey's share in the EU energy supply will be 6.8%, even though it is now zero. In comparison with such energy "monsters" as Russia or Norway, this is not enough. But for the gas market of South-Eastern Europe, Turkey's contribution will be significant.

In addition, Ankara intends to seriously engage in its own production. In particular, the Ministry of Energy of Turkey announced the first-in-its-history purchase of a drilling vessel. Yes, from Russia. Why should that be cause for surprise, you might ask. Because Moscow with its own hands is helping Ankara to reduce its energy dependence on Moscow and become the largest "transit sultanate" on the gas map of Europe. But, as I said, this is only how it appears at first glance…

"Revenge" through Egypt

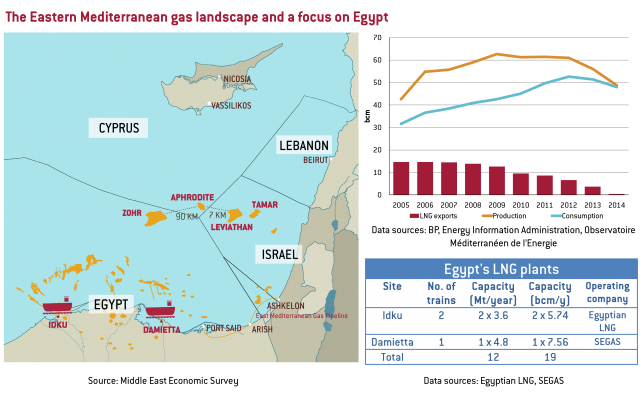

As analysts of the authoritative research center Turkish Energy Fund (TENVA) wrote in their recent report, Egypt can prevent Turkey from becoming the main hub in the region. This is primarily about one of the world's largest deposits of blue fuel, called Zohr. The real situation is attached to the strained relations between the leaders of the two countries- it's no secret that the Turkish president still refuses to recognize his colleague Abdul-Fattah As Sissi, who headed Egypt after the military coup in 2013.

According to Italian geological department Eni, which is developing Zohr, an open field of 100 square km can store up to 30 trillion cubic feet of dry gas within. For comparison, the stocks of the Israeli Leviathan oil advertised by the European press are "only" 14-20 trillion cubic feet. Russia made sure to get its hands on a part of that grandiose project and at the end of last year, Rosneft bought about 35% of the concession agreement for the development of Zohr from Eni. Another 15% was purchased by British Petroleum (BP). The cost of the Rosneft stake, according to analysts, is about $1.12 billion, while Igor Sechin's (Head of Rosneft) total investment in the project over four years could reach $4.5 billion.

This is why the Russian energy expansion in the Mediterranean through Egypt is ongoing. Rosneft Trading SA (RTSA) and the Egyptian State Gas Company Egyptian Natural Gas Holding Company (EGAS) signed a contract for the supply of ten LNG tankers, with a total volume of 600,000 tons, at the beginning of 2017. Thanks to these investments, Russia is becoming an even more significant player in the energy market of the region. And this quite significantly limits the prospects for the growth of Turkish influence as the main gas hub in Europe. An increase in demand for blue fuel in the EU is the only thing that could make the situation more profitable for Ankara. But such a scenario is hard to believe. And the point here is not only in the dynamics of demand, but also in the policy of Brussels.

"Turkey has plans to create a gas hub, so the Turks want to concentrate as many gas pipelines as possible," said Igor Yushkov, a leading expert of the National Energy Security Fund and lecturer at the Finance University under the Government of the Russian Federation. "It is unprofitable for them if Russia resumes the South Stream project in Bulgaria. Although, for Russia itself, this would be the most attractive route. Further, he EU does not want to fall into additional dependence on transit through Turkey- and Azerbaijani gas is already to go through it. And then Ankara wants to "drag" in the Iranian transit. However, Tehran, as I understand, is not rushing to Europe with its gas pipelines.

Thus, Turkey is unlikely to become such a significant transit player "diversifier" from Russia. Preserving and, if possible, multiplying its leverage on Ankara is extremely important for Moscow. The Turkish wolf will never attack the Russian bear alone. And after the referendum held in Turkey a few days ago, the results of which for Europe were not positive, Turkey can expect to receive a much smaller supporting pack from West Europe when it howls.

However, despite the warming of recent months, relations between Moscow and Ankara are far from trusting. The positions of the countries differ both in Syria, in Crimea, and in the issues of the food embargo. Yes, for some important energy projects for Moscow, such as the "Turkish stream" and the “Akkuyu” nuclear power plant, from time to time there are certain concerns. But the main problem in the Russia and Turkey scenario is that a wolf is no comrade to a bear.

By Dimitri Dolaberidze