Tourism Market Watch: MAY

Sector research is one of the key directions of Galt & Taggart Research. We currently provide coverage of Energy, Healthcare, Tourism, Agriculture, Wine, and Real Estate sectors in Georgia. As part of our tourism sector coverage, we produce a monthly Tourism Market Watch, adapted here for Georgia Today’s readers. Previous reports on the sector can be found on Galt & Taggart’s website - gtresearch.ge.

For Georgia Today by Kakhaber Samkurashvili

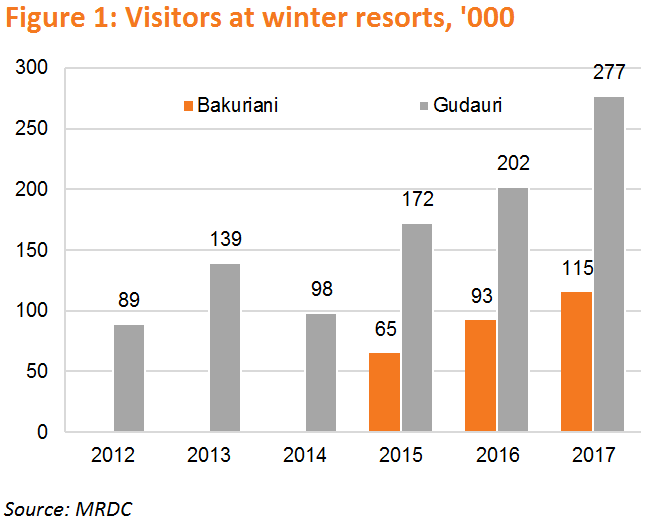

Number of visitors at Georgia’s mountain resorts reaches historical high during the 2016-2017 season

Mountain Resorts Development Company (MRDC), the managing entity of Georgian winter resorts, has released a summary of the season. Thanks to favorable weather conditions, the season opened early in December in Gudauri and by the end of the year, all winter resorts were receiving guests. The early start provided a welcome boost, as the total number of visitors to Georgia’s winter resorts exceeded 400,000 (+37.0% y/y) during the season. Notably, according to MRDC, only about 20% of the visitors were foreign visitors, leaving significant upside potential.

Gudauri remains the most popular ski resort, hosting more than 276,000 visitors during the season, up 37.1% y/y

The number of visitors to Gudauri has increased more than three-fold from almost 89,000 visitors during the 2011-2012 season. The resort’s proximity to the Russian border makes it especially attractive for Russian skiers. Currently Gudauri features 10 ski lifts, with combined tracks of approximately 70km, and visitors can enjoy skiing, snowboarding, paragliding, and heli-skiing. MRDC and the Ministry of Regional Development and Infrastructure are currently working on a 7.5km Kobi-Gudauri ski lift, which will connect Gudauri with Kazbegi. The project is expected to be finished by end-2018 and will be the longest lift in the Caucasus. Other projects include an artificial lake for snowmaking purposes, which would prolong the winter season in Gudauri.

Real Estate Development Company (Red-co) to invest US$ 150mn in Gudauri

The company presented a four-phase project that was prepared according to the 2015 master plan for further development of the Gudauri resort, created by Ecosign Mountain Planners LTD, a Canadian company. Red-co acquired 50 hectares of land to implement its plans. The company currently operates with four apart-hotels, featuring approximately 350 rooms, in New Gudauri. The massive project envisages the construction of 26 buildings and will provide an additional 4,200 beds in hotels, apart-hotels, townhouses, and villas. The master plan also includes entertainment facilities, such as restaurants, spa centers, sports grounds, and a casino. During each phase of the project, Red-Co plans to introduce an international branded hotel. A 170-room Radisson Blu is expected to be completed in 2018 and the company has also received preliminary approval from Starwood Hotels and Resorts to open Sheraton and Four Points by Sheraton hotels in the future

Major development in the works for Bakuriani, which hosted over 115,000 visitors in the 2016-2017 season, up 24.6% y/y

The coming years will see Olympic infrastructure development at the resort, with a biathlon track, ski jumping hills, and an ice hockey rink in the pipeline. Furthermore, Georgian Reconstruction and Development Company (GRDC), in a PPP with the Georgian government, plans to invest GEL 100mn in the development of the Kokhta-Mitarbi resort, adjacent to Bakuriani. The resort will be developed according to a master plan prepared by the industry leader, Geode. The first phase of the development will feature a 100-room hotel, set to open by end-2017, and a 500-unit apartment complex, part of which is also expected to be completed by the 2017-2018 season.

Winter resorts in Svaneti and Adjara regions also have strong development potential

Tetnuldi, which opened at the end of 2016, hosted nearly 9,000 visitors this season, while the nearby Hatsvali received over 7,300 visitors. Development plans include new 1.8km and 3.5km ski lifts connecting Mestia to Hatsvali and Tetnuldi, respectively, which will considerably improve access to the resorts year-round. The number of visitors at the Goderdzi resort was down 34.3% y/y to slightly less than 4,500. The unrealized potential of this resort, largely due to a severe shortage of accommodation units, has been recognized as an opportunity by investors. Alliance Group announced plans to open a 4-star, 100-room Ramada Resorts hotel in Goderdzi in 2018, while Metro Atlas Georgia is planning to open a 5-star Metro Sky Tower by end-2018. Both hotels will feature casinos.

Tbilisi hosts 3rd Euro-Asian Mountain Resorts Conference

The conference was organized by the government of Georgia and MRDC under the title, Innovative Strategies for Sustainable Mountain Tourism Development. Government officials, international experts, and industry-leading companies gathered in Tbilisi and discussed the challenges and opportunities of Georgian mountain tourism.

Number of international arrivals up 5.7% y/y to 0.55mn in May 2017

Out of the top four source markets, there was strong growth from Armenia (+8.9% y/y), Azerbaijan (+8.5% y/y) and Russia (+16.8% y/y). A 24.4% y/y decrease in arrivals from Turkey, in line with the downward trend of the last few months, was the main drag on growth in the total number of visitors.Arrivals from the EU were up 13.0% y/y to over 28,000 visitors, while Ukraine also posted solid growth (+20.2% y/y).

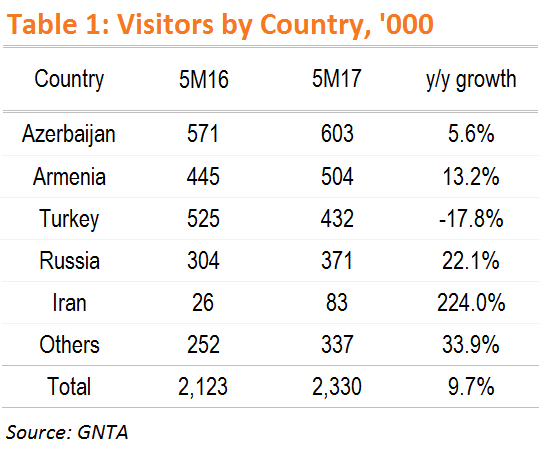

Number of international arrivals in the first 5 months of 2017 up 9.7% y/y to 2.33mn visitors

The number of visitors increased from all major source countries except for Turkey (-17.8% y/y). The largest individual contributors to overall growth were Armenia (+13.2% y/y, +2.8ppts) and Russia (+22.1% y/y, +3.2ppts), while Azerbaijan contributed 1.5 percentage points, as the number of visitors from Azerbaijan posted a modest increase of 5.6% y/y from the high base of the first five months of 2016 (+22.1% y/y).

While the top four source markets accounted for 82.0% of total international arrivals January - May, secondary source markets also post robust performances

Arrival growth from secondary (non-EU) source markets contributed 5.4ppts to the overall growth of 9.7% y/y. The number of Iranian visitors was up 3.2x to nearly 83,000visitors.The number of Indian visitors was up 122.7% y/y to over 21,000, while the number of Israeli visitors increased 54.9% y/y to almost 32,000 visitors. Arrivals from the EU were up 21.9% y/y to over 93,000 visitors, with Germany (+26.7% y/y), Poland (+21.4% y/y), and UK (+22.1% y/y) driving the growth.

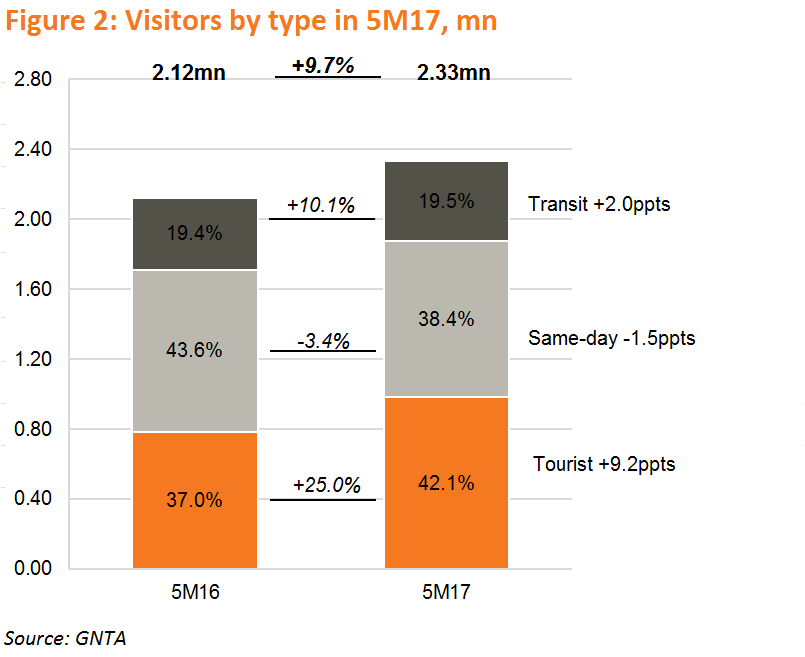

Tourist category continues to drive arrival growth in May 2017

The number of overnight visitors (‘tourist’ category) was up 19.6% y/y and accounted for 44.4% of international arrivals. Same-day arrivals were down 9.2% y/y, while the number of transit visitors increased 7.2% y/y. In the first five months of 2017, the number of tourist arrivals is up 25.0% y/y to 0.98mn, while the number of same-day visitors is down 3.4% y/y and the number of transit visitors is up 10.1% y/y.

Photo: CBW