Electricity Market Watch: JULY

Sector research is one of the key directions of Galt & Taggart Research. We currently provide coverage of Energy, Healthcare, Tourism, Agriculture, Wine, and Real Estate sectors in Georgia. As part of our energy sector coverage, we produce a monthly Electricity Market Watch, adapted here for Georgia Today’s readers. Previous reports on the sector can be found on Galt & Taggart’s website - gtresearch.ge.

For Georgia Today by Mariam Chakhvashvili

Changes in electricity and gas market rules and regulations

By signing the Energy Community charter in October 2016, Georgia took on the obligation to synchronize Georgian legislation with EU standards in the energy sector. On June 30, 2017, changes were made to the Law on Electricity and Natural Gas, setting deadlines for the gradual opening of the market and filling the gaps in the current secondary legislation. Changes in the natural gas sector are more technical – the Grid Code for Natural Gas, which needs to be developed and approved by September 2018, will regulate the technical aspects of natural gas supply for each market participant. Changes in the electricity sector are more significant, as they will result in an increase in the number of players outside the regulated market and stimulate competitive trades between market participants.

Degree of deregulation in electricity market set to increase in 2018

Currently all TPPs, as well as HPPs constructed before August 1, 2008, with installed capacity of over 13MW, are regulated by GNERC, which limits their ability to sell electricity for more than the predetermined tariff. According to the changes to the Law on Electricity and Natural Gas, the minimum threshold will increase from 13MW to 40MW as of January 1, 2018. Based on our estimates, this change will result in an increase in the share of deregulated power plants from 15.5% to 20.5% of total installed capacity and about 3.1TWh (26.0% of electricity supply in 2016) will be supplied to the Georgian market at unregulated prices annually over 2018-2019. Notably, 77.6% of deregulated power plants (in terms of installed capacity) have PPAs with ESCO. Therefore, a significant portion of the newly deregulated generation will still be traded through ESCO at the rate and for the period set out in the respective PPAs.

Direct consumers set to account for at least a quarter of total electricity consumption in Georgia

According to the changes to the Law on Electricity and Natural Gas, starting May 1, 2018, consumers connected to high voltage (35kv and above) transmission lines will automatically be registered as direct consumers. This change will result in an increase in the number of direct consumers from two to over 60, with aggregate annual consumption of at least 3.1TWh (28.2% of 2016 consumption). Other companies will retain the option to be registered as direct consumers. The increase in the number of players on the unregulated market should foster price competitiveness for all market participants. Furthermore, such legislative changes can lead to electricity traders appearing on the market, which can be beneficial for direct consumers, as they offer various services, including fixed price contracts and one-shot payments, among others.

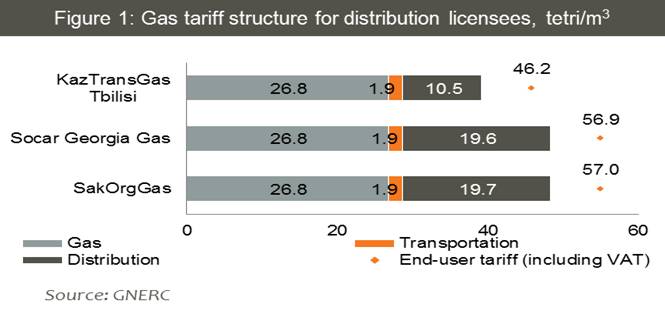

New end-user tariffs for natural gas

GNERC has recalculated natural gas end-user tariffs for the three leading gas distribution companies, which together accounted for 89.8% of the market in 2016. Old tariffs varied by region and supply pressure, while the new methodology sets a uniform, transparent tariff structure. The end-user tariff is comprised of three components: transmission, cost of gas, and distribution. The transmission tariff, which has remained unchanged for 17 years, is now set at 1.884 tetri/m3 for all consumers, an average increase of 0.5 tetri/m3. Cost of gas, which now incorporates a government subsidy of 5 tetri/m3, in effect since March 2013, is set at 26.8 tetri/m3 (a decrease of 12.5%, as stated by the officials). The distribution tariff, designed to cover the distribution licensee’s investment costs, is the only remaining driver of tariff differences among distribution companies. End-user tariffs (including VAT) per m3 as of July 20, 2017 are set at 46.153 tetri for KazTransGas Tbilisi (+1.2%); 56.940 tetri for Socar Georgia Gas (+26.7%, on average); and 57.011 tetri for SakOrgGas (+30.5%, on average). Notably, these changes apply only to regulated users, which account for 47% of total supply. Consumers who were connected to the national gas infrastructure in the regions after Sep-2007 and in Tbilisi after Aug-2008 are deregulated and pay the prices set independently by distributors (50 to 63 tetri/m3 on average). The Ministry of Energy has voiced the possibility of the entire gas distribution market becoming regulated, with a uniform tariff structure for all users.

Energo-pro buys Kakheti Energy Distribution

Kakheti Energy Distribution was sold for GEL 21.7mn at a public auction. The buyer was Energo-Pro Georgia, the largest electricity distribution company in Georgia, whose market share will increase from 60.2% to 64.6% as a result of this transaction. Energo-Pro Georgia will become the sole electricity distributor in Georgia outside of Tbilisi. Kakheti Energy Distribution has operated in bankruptcy since 2011, managed by a representative of the National Bureau of Enforcement. For three years prior, the company was owned by a Lithuanian concern, Achemos Grupe. Current outstanding debt of GEL 21mn will be paid off from the GEL 21.7mn purchase price.

Electricity Consumption and Generation – June 2017

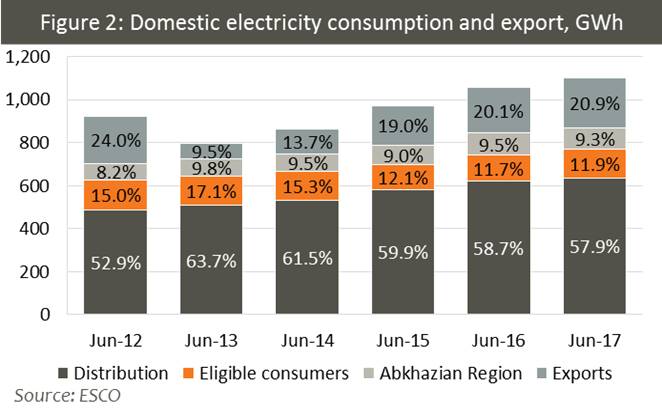

Domestic consumption increased 3.1% y/y in June 2017 and 6.9% y/y in 1H17. Consumption of distribution companies increased 2.9% y/y in June. The Abkhazian region’s electricity usage was up 1.3% y/y and accounted for 9.3% of domestic consumption. Consumption by eligible consumers was up 5.6% y/y, with Georgian Manganese usage up 10.3% y/y.

Diversified export markets

Electricity exports increased 8.6% y/y in June 2017 to 230.1 GWh and 7.4% y/y in 1H17. 28.3% of exported electricity went to Turkey, down 38.8% y/y. The top exporters to Turkey were Georgian Urban Energy (58.0% of total) and Adjar Energy 2007 (26.2% of total). ESCO also exported 5.1 GWh (8.0% of total) to Turkey, in exchange for electricity imports from Azerbaijan in 2012. Exports to Armenia decreased 2.3% y/y and accounted for 18.4% of total exports, split between GIEC (60.3%) and ESCO (39.7%), which exported electricity in exchange for the electricity imported during Feb-Apr from Armenia. Exports to Russia almost doubled (+98.2% y/y) and accounted for over half of electricity exports (53.3%), with ESCO being the sole exporter. The reason behind the increase in exports to Russia was an unexpected surplus of generation in the second half of the month and inflexibility of other markets to import additional electricity on short notice. Overall, ESCO accounted for 63.4% of total electricity exports in June 2017.

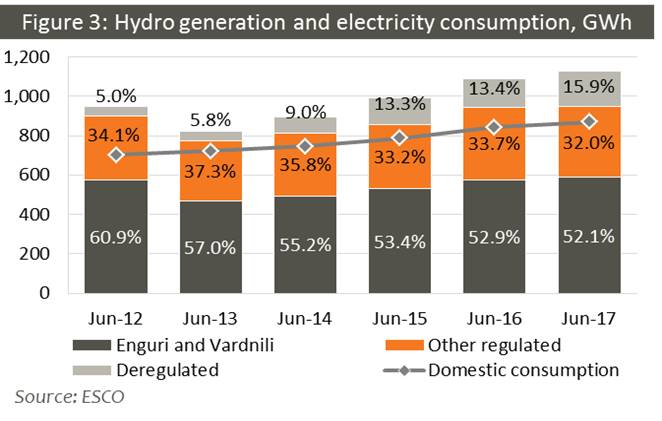

HPP generation satisfied electricity demand

Electricity demand was satisfied largely by hydro generation, with 99.1% in the supply mix. The new wind power plant accounted for 0.8% of total electricity supply. 20.9% of domestic generation was exported. Total hydro generation was up 3.4% y/y. Deregulated HPPs posted a 22.7% y/y increase in generation, due to the addition of Dariali and Khelvachauri HPPs, while generation was up only 1.8% y/y by Enguri/Vardnili and down 1.8% y/y by other regulated HPPs. The guaranteed capacity fee was halved, down 50.5% y/y to USc 0.39/kWh, as Block 3 and Gardabani CCGT were under maintenance for the entire month and did not receive guaranteed capacity payments, while the other TPPs provided guaranteed capacity for the entire month.

Electricity Prices in Georgia and Turkey

Wholesale market prices in Georgia increased 5.0% y/y to USc 5.1/kWh. Only 4.8% of total electricity supplied to the grid in June 2017 was traded through the market operator, with the rest traded through bilateral contracts. The average monthly market clearing price in Turkey decreased 17.0% y/y to USc 4.3/kWh, 14.9% below the Georgian wholesale market price in June 2017.