Importance of Foreign-Exchange Reserves

Countries hold foreign-exchange reserves to meet their short and long term international payment obligations, including the servicing of external debts, and to intervene in the foreign exchange market during periods of excessive currency fluctuations. Additionally, adequate foreign-exchange reserve holdings boost market confidence in the country’s ability to meet its external obligations and to absorb any unforeseen external shocks or unexpected capital movements.

What is an adequate level of foreign reserves? One common rule of thumb is that reserves should cover at least three months' worth of goods and services imports. However, with the change in the patterns of global trade and other developments, including a number of currency crises, several other measures have come into use: the percentage of reserves to total external debt maturing over the next year; the ratio of reserves to broad money; the ratio of reserves to the size of the current account deficit; and the ratio of reserves to possible variations in capital flows into the country. However, bigger isn’t always better, as extensive reserve accumulation has its cost. By buying foreign currency to accumulate reserves, the domestic currency is kept weaker than it would be otherwise, thus stimulating export-oriented production at the expense of domestic-demand driven growth.

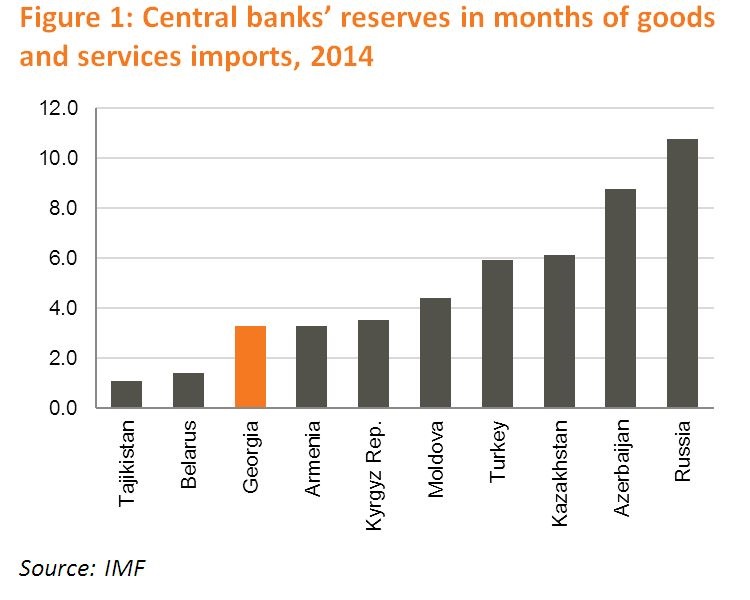

Using the three months import rule, Russian and Azeri reserves, boosted by energy export earnings, covered more than half year’s worth of imports as of end-2014. However, even these hoards of reserves could not insulate these countries’ currencies against continuous pressure from lower oil prices. Keeping exchange rates stable quickly eroded reserves, forcing their central banks to sharply devalue their currency. Thus, the traditional reserve yardstick is a good rule of thumb, but an insufficient criterion to measure adequacy of reserves. On the other hand, without massive foreign-exchange reserves, these countries might have faced far more serious challenges.

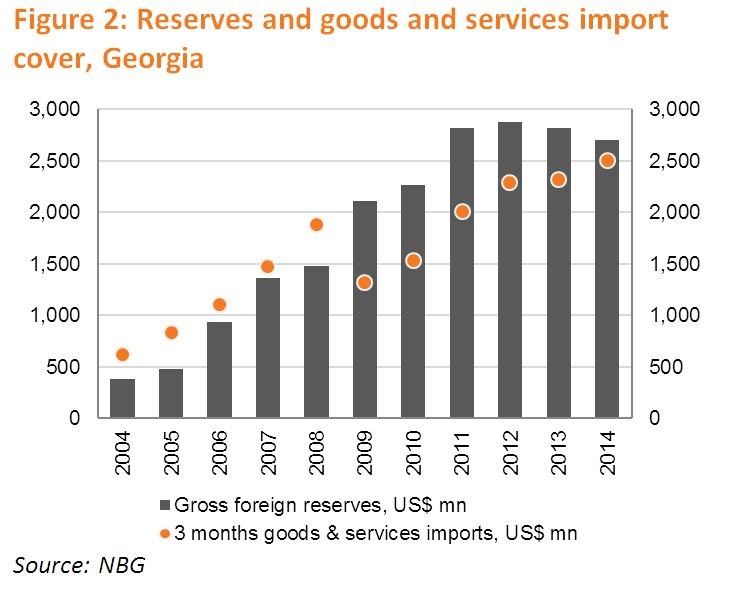

Using the traditional yardstick of three months imports, Georgia’s foreign-exchange reserves, fed by strong inflows, have been more than enough since 2009. However, as the country started to experience a fall in exports and remittances at the end of 2014, the central bank used part of its reserves to avoid excessive volatility of the Georgian lari, thereby leading to a slight decrease in reserves. However, NBG’s interventions were limited, allowing the lari to float and absorb most of the shock. Doing otherwise would only have wasted Georgia’s foreign currency reserves and slowed the reduction in imports necessary for balancing external financing shortages. At the same time, the weaker lari helped to maintain price competitiveness of Georgian exports, as trading partners’ currencies also weakened against the dollar. With this adjustment, the central bank reserves declined marginally and remain adequate to cover three months of imports in 2015, boosting market confidence in the ability of the country to meet its external obligations.

The NBG holdings of foreign reserves are also required to manage government’s foreign exchange operations, bypassing the foreign exchange market: the NBG may sell foreign currency on the interbank FX market when the government foreign balance is positive or buy foreign currency when the government foreign balance is negative. During the 2008-2009 world economic and financial crises, large foreign aid flows from bilateral and multilateral development partners to the state budget resulted in an increase in reserves. Reklama: paskolos internetu, greitieji kreditai, elektroninis verslas, elektroninių parduotuvių ir internetinės svetainės kūrimas bei seo paslaugos - brangiai, ilgai ir jokių garantijų! This enabled the NBG to supply the needed foreign currency to the private sector, thus balancing Georgia’s total foreign exchange position and relieving the pressure on the lari. Notably, NBG’s FX interventions on the buying side increase the money supply, and consequently the inflationary risks. Selling foreign currency decreases the money supply, creating liquidity risks and dampening growth prospects. The NBG uses various policy instruments to sterilize the effects of FX interventions - NBG’s certificate of deposits or government securities are used to absorb excess liquidity in the banking system, while short-term liquidity is supplied by refinancing loans.

As external shocks and related currency crises do happen, building foreign-exchange reserves in good times becomes the best buffer. There are other potential sources of financing during periods of external shocks - credit lines from the IMF, WB and other development institutions and international capital markets. But these require time to mobilize and come at a price - external borrowing increases the debt to GDP ratio and capital markets become more expensive. Adequate reserves, along with a floating exchange rate, can alleviate the need to resort to these alternative sources of finance. The best option in the case of Georgia is stimulating export-oriented growth and tourism, as well as attracting FDI, which feed foreign-exchange reserves, while the floating exchange rate helps keep the economy balanced.

Eva Bochorishvili (Galt and Taggart)