Electricity Market Watch

Sector research is one of the key directions of Galt & Taggart Research. We currently provide coverage of Energy, Healthcare, Tourism, Agriculture, Wine, and Real Estate sectors in Georgia. As part of our energy sector coverage, we produce a monthly Electricity Market Watch, adapted here for Georgia Today’s readers. Previous reports on the sector can be found on Galt & Taggart’s website - gtresearch.ge.

Investments in transmission projects

Total investment for transmission projects is estimated at EUR 683.9mn over 2018-2028. The Ten Year Network Development Plan (TYNDP) for 2018-2028 approved on 28 December 2017 incorporates revised forecasts of electricity consumption growth, and updated pipelines of power plant and transmission network projects. The TYNDP targets 48.8% of total investment to be spent over 2018-2020, mostly financed by credits from IFIs (KfW, EBRD, WB, ADB, EU-NIF) and GSE’s own resources. Under the previous edition of TYNDP total estimated investment stood at EUR 735.4mn, and the decrease largely reflects already implemented projects in 2017: high voltage transmission lines - Batumi1, Batumi2, Derchi, Sataflia 2, Ajameti 3, etc. and substations - Jandara, Shindisi, etc. Commissioning dates for cross-border transmission projects were revised to 2020 from 2018 for 400kV line Marneuli (Armenia) and 154kV line Batumi-Muratli (Turkey), to 2021 from 2020 for 400kV line Akhaltsikhe-Tortum (Turkey) and to 2023 from 2021 for 500kV line Stepantsminda (Russia).

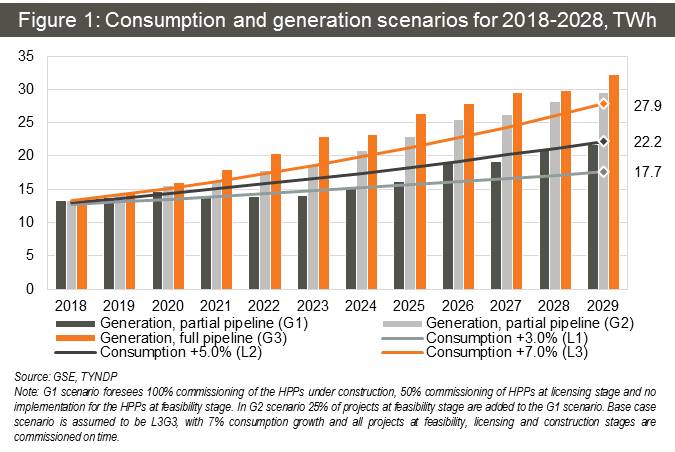

Forecast for electricity consumption growth revised upwards in TYNDP 2018-2028

The annual consumption growth rates in the pessimistic, moderate and optimistic scenarios are revised upwards from 1.0%, 3.5% and 5.0% to 3.0%, 5.0% and 7.0%, respectively. The generation scenarios vary by the assumed rates of commissioning for the power plant projects at different stages of development. The base case scenario is assumed to be L3G3, with consumption growth rate at 7.0% (reaching 27.9TWh in 2029) and full utilization of HPPs under construction, licensing and development stages, resulting in 32.3TWh total domestic generation in 2029. The base case scenario gives approximately 4.4TWh of net exports in 2029.

LEAP model for Georgia forecasts 3.9% annual average growth of domestic consumption 2015-2030

The Long-range Energy Alternatives Planning (LEAP) model was developed by Energy Efficiency Center Georgia (EEC), under the USAID’s Governing for Growth (G4G) grant project “Electricity Demand Forecasting Model”, enabling forecasting of monthly electricity demand and peak loads. The model uses a bottom-up approach, evaluating the end-use in household, commercial and public services, industry, transport, agriculture, forestry and fishing, crypto-currency mining, Abkhazian region and the losses of the system.

In total, five scenarios are discussed in the report. The baseline scenario assumes the consumption trend without implementation of any new policies and takes into account past trends and functional relationships between demand drivers and end-uses, resulting in 18.9TWh annual consumption in 2030; The other scenarios include: 1) energy efficient scenario, decreasing forecasted consumption of 2030 to 16.6TWh, 2) costumer-owned generation scenario (18.8TWh in 2030) and 3-4) two variations in GDP growth forecast, showing that 10% variation in GDP growth from base case scenario will lead to 0.7 TWh variation in consumption growth in 2030.

Legislative changes expected in 2018

Several important legislative changes are expected in 2018. Georgia’s obligation under the Energy Community Treaty, signed in October 2016, includes implementation of seven different EU directives and regulations before the end of this year. The most significant is the directive concerning the common rules for the internal market in electricity (N2009/72/EC). We expect the first draft to be publicly available in late spring, 2018.

Other EU directives due this year are: N2009/28/EC on promotion of the use of energy from renewable sources; N2012/27/EU on energy efficiency, directive N714/2009 on conditions for access to the network for cross-border exchanges in electricity; N2001/80/EC on the limitation of emissions of certain pollutants into the air from large combustion plants; N2010/75/EU on industrial emissions for new plants; N2010/30/EU on the indication by labeling and standard product information of the consumption of energy and other sources by energy-related products. There are several grant programs from different countries, assisting Georgia in reaching its goals toward the Energy community and implementing these acquis into the Georgian legislation

Renewable energy primary law for Georgia expected to be adopted in August 2018

The draft is being prepared with the assistance of the Norwegian Water Resources and Energy Directorate and Danish consortium NVE-NIRAS. The project aims to fulfill Georgia’s obligation under Energy Community treaty towards implementation of directive N2009/28/EC. The directive requests contracting parties to set and therefore achieve national goals for the share of renewable energy into the total sources consumed in transport, electricity, heating and cooling by 2020. The law should define states’ policy principles, missions, and general requirements, also promote the schemes supporting renewable energy.

After adoption of the law, the secondary legislation will cover items such as detailed schemes on trading of renewable energy, approaches and procedures on integration of renewable energy into the grid, detailed rules and control mechanisms on implementation of obligatory quota for renewable sources in the transport sector, control and regulation of the construction norms, etc. The current scope for Niras, also includes preparation of action plan for implementation of the secondary legislation. This activity is financed by the US$ 4mn grant from the Kingdom of Norway, and also includes trainings for students of Georgian Technical University and relevant Government institutions, working explicitly on renewable energy sources.

USAID launched US$ 7.5mn 3-year technical assistance project

USAID Energy Program (UEP) aims supporting Georgia in energy market and cross-border trade development via capacity building for government institutions and other market players. The program also concentrates on non-hydro renewables, willing to establish enabling environment and investment promotion plans; to support the wind farm developers and GSE in integrating new variable renewable energy (VRE) plants into the grid; and to advise the Government of Georgia on energy security policy and complex energy infrastructure operations, based on detailed domestic and regional studies. These measures will help Georgia to fulfill its obligations under the Energy Community Treaty.

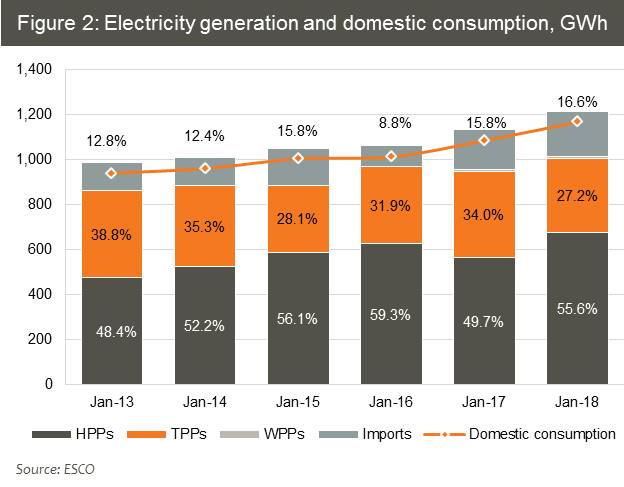

Electricity consumption and generation – January 2018

Domestic electricity consumption increased 7.6% y/y to 1.2TWh, slightly below the planned level (-2.3%). The growth was driven by 11.9% increase in consumption by distribution licensees: consumption by Energo-Pro Georgia subscribers, including former Kakheti Energy Distribution subscribers, increased 17.2% y/y, from relatively low level in January 2017 (2.7% y/y); Telasi consumption was up 3.6% y/y, albeit from a high base in January 2017 (+10.5% y/y). Electricity usage by eligible consumers showed slight increase (+0.9% y/y), while Abkhazian regions consumption was down 1.9% y/y. Electricity export and transit didn’t take place in January, 2018.

Electricity generated by domestic sources increased by 6.1% y/y to 1.0TWh, slightly above (+2.2%) the planned level. Hydro generation showed significant increase (+19.9%y/y) from a low base (-10.4%y/y) in January, 2017. Enguri/Vardnili generation was slightly down 2.7% y/y, while generation of other regulated and deregulated HPPs increased 43.9% y/y and 34.4% y/y, respectively. Thermal generation declined 14.0% y/y, which was 18.3% below the planned level. Wind generation increased 9.6%y/y to 7.1GWh and contributed 0.6% of total supply.

Electricity import increased 12.9% y/y to 202.1GWh, and accounted for 16.6% of total electricity supplied to the grid in January 2018. Notably, electricity import was 22.5% below the planned level. 92.2% of imported electricity came from Azerbaijan, while the rest came from Russia (4.0%) and Armenia (3.7%). The guaranteed capacity fee was up 6.4% y/y to USc 0.7/kWh. The increase can be explained by new guaranteed capacity fee rates in force from January, 2018. Gardabani CCGT and Mtkvari Energy operated at full power for almost the entire month, while the other three thermal power plants were mostly on standby.

Electricity prices in Georgia and Turkey

The average import price was up 3.2% y/y to USc 5.1/kWh. However, the wholesale market prices in Georgia was slightly decreased to USc 5.0/kWh (-1.1% y/y). Electricity traded at the wholesale price through the market operator accounted for 19.7% of total electricity supplied to the grid in January 2018, with the rest traded through bilateral contracts. The average monthly market clearing price in Turkey decreased -2.4% y/y to USc 4.9/kWh in January 2018.

Mariam Chakhvashvili